Dolly Parton summed it up in her 1980 hit song 9 to 5; “Workin 9 to 5, what a way to make a livin’, barely gettin’ by, it’s all takin’ and no givin’”.

As hard as we work, it often feels like our paycheque leaves our bank account as quickly as it enters, most likely to pay for upcoming (or overdue) bills and expenses. And it’s not just a feeling; living expenses are growing and wages are not keeping pace.

Financially, it is a stressful time. Finder’s Consumer Sentiment Tracker found that 35% of Australians ranked rent or mortgage in their top three most stressful bills over the past six months, followed by groceries (31%), petrol (26%) and energy (21%). Only 15% said they weren’t stressed about bills at all.

If you are part of the 85% that did experience bill related stress, we want to introduce you to new fintech Nine25. It uses ‘Salary Streaming™’ to help people stress less about their finances and reduce (and prevent) debt.

We chatted with fintech veteran and Nine25 Founder, Leigh Dunsford, about how the app is shaking up the traditional pay cycle and helping customers change their relationship with money– for good. Less takin’, more givin’.

Workin’ Nine25

What is it?

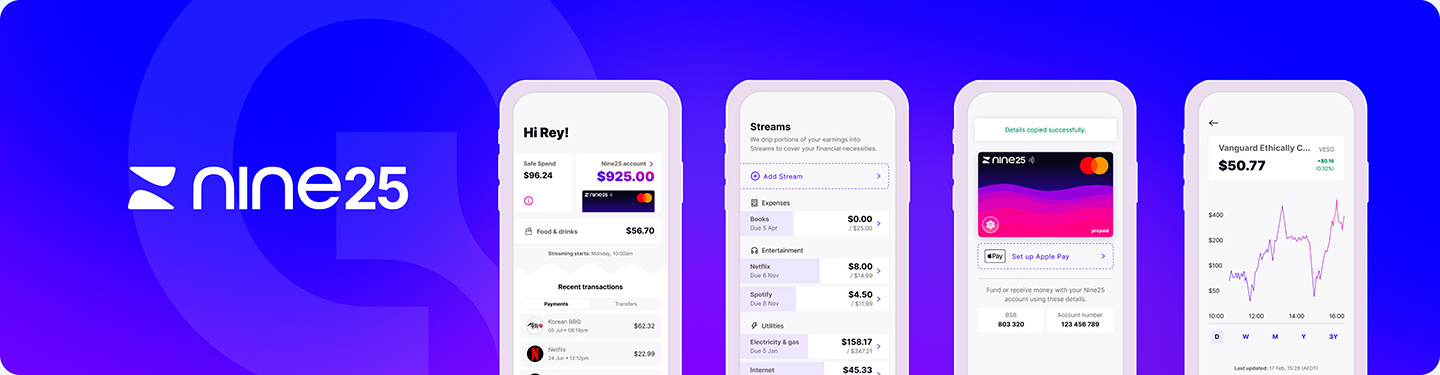

Nine25 is not your typical money management app. It is a subscription streaming service that helps people manage their money, in real time, as they earn it. Think of it as a personal bookkeeper.

Users are supported by three key features:

- Salary Streaming: Streams a customer’s net salary into their account every hour, which then reconciles at the end of the month.

- Bill Streams: Late fees are a thing of the past using automated bill savings and payments.

- Safe Spend: After taking all bills and expenses into account, users know how much money is leftover to spend as they please.

Who is it for?

Nine25 is targeted at people who want to get on top of their finances, and not the other way round. They have probably tried countless budgeting methods that have not worked for them and need a little help.

How it works

- Download the app and create a Nine25 Account within minutes.

- Securely connect a bank account and employment software (such as payroll) to verify earnings and employment details.

- The Nine25 app calculates the hourly rate based on this information, and uses a Basiq Connector to verify identity and spending behaviours.

- Switch salary deposits to the Nine25 Account to activate Salary Streaming.

- Once set up, salary will stream to the Nine25 Account each hour instead of landing in a bank account at the end of every pay cycle. Salary is also distributed across upcoming bills, as entered, to ensure they are paid on time, everytime.

The Nine25 founder story

Kickin’ the quick credit fix

The idea for Nine25 came about as a natural next step after Leigh developed a software product designed to help businesses during periods of reduced cash flow. It struck him that individuals also had the same challenges but not the same solutions, often relying on quick and potentially expensive credit options.

“We wanted to come up with a solution that taught the next generation how to manage money through the cycles of their life without relying on credit products and services. Providing credit products to those who don’t have the knowledge or tools to manage their finances can be very problematic,” said Leigh.

“Those payday loans can cause substantial hurt. Once people get into this cycle, it can be a hard one to break, impacting a person’s credit score or their ability to access credit for the rest of their lives.”

“We wanted to remind people how to spend their own money again, rather than relying on quick fixes to stretch their wallets (and their stressed heads) until the next pay day.” Leigh said.

“If you think about it, our entire lives are structured around when we are paid and the payments we have to make. For whatever reason, it is not unusual for people to experience a mismatch between pay and bill cycles. I wanted to come up with a way that was ethical and responsible to disrupt the cycle and help people get on top of their finances,”

Leigh Dunsford, Founder, Nine25.

Livin’ on the Stream

In today’s world, cash is no longer king. Good luck finding businesses that will accept it. The increased use of cards and digital payment methods has somewhat changed the perceived value of money; now it’s just a number on a screen, it’s easier to spend than ever.

Despite how the Nine25 app functions, Leigh says it is actually intended to help people save.

“The weirdest thing that happens when users start living on the stream, is they feel like they are constantly being paid. With the traditional pay cycle, your account balance is always going down, with Nine25 you are able to watch it continuously increase,” said Leigh.

“By seeing that money come in, in real time, as it is earned, it has the potential to change the relationship people have with money and its perceived value. Therefore, encouraging more people to save or rethink that impulse purchase.”

Learning to consciously spend

The most unique feature of the Nine25 app is the allocation of a ‘Safe Spend’ amount. The app’s first priority is ensuring customers’ bills and other priorities like rent are paid on time, however it also tells them how much money is leftover to spend on whatever they wish.

Leigh says the intent is to encourage people to use the money they earn to save up for the things they want, rather than relying on credit.

“While we are trying to break the tradition of the pay cycle, we want to encourage a more conservative mindset when it comes to saving and spending. We want to help people save for that big purchase or hit that investment goal,” said Leigh.

“With Nine25, users are able to watch their Safe Spend grow and know that it will decrease if they decide to make a purchase. It’s all about conscious spending. That complete visibility in real time helps users make better purchasing decisions, because they know if they can (or can’t) afford something,” Leigh said.

Benefits to businesses

Leigh added that an additional benefit is that businesses can offer Nine25’s Salary Streaming to their employees to help attract and retain staff.

“Employers are really struggling to find good talent and are searching for incentives to encourage people to apply for positions. We want to suggest offering Salary Streaming as an option,” said Leigh.

“We have heard many people want to apply for a new job, but can’t afford to move because of the pay cycle. They don’t have the luxury of waiting, sometimes up to a month, to be paid. Salary streaming could change all that and be a real advantage to businesses,” Leigh said.

Accessing customer data via Basiq

Leigh says financial data is crucial for measuring success and delivering innovative products.

“Aggregated data will help tell us how effective the Nine25 app is by measuring changes in users’ behaviour and the flow on effects. For example, if better financial management directly correlates with improving a person’s performance at work or overall mental health,” said Leigh.

“We decided to use Basiq because of its data capability and, when it comes to coverage of Australian banks, it’s one of the best. We also wanted to partner with someone close to the Australian market; localisation is so important to us.”

What’s next for Nine25?

Nine25 also has their sights set on serving a critically underserved customer segment: Australian gig economy workers. It plans on releasing an additional 50 integrations in 2022 across payroll and gig platforms that will enable workers to receive money as they earn it.

With the current economic climate, launching Nine25 in the market could make a real difference to Australians stressing about bills and struggling to get on top of their finances.

It’s not meant to be a quick fix product, but one that can be embedded into a person’s lifestyle. It will help establish good money habits and set them up for a more financially confident future. Less takin’, more givin’.

Nine25 is a Basiq Startup Launchpad customer, supported by Basiq’s Connect and Enrich products.

References:https://www.finder.com.au/australian-household-spending-statistics

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.