Insights

Uncover valuable

insights from data

While accessing data is a crucial step in developing a financial application, extracting insights from it is what truly unlocks its value. With Basiq's comprehensive data overlay services, you can harness the power of data and focus on delivering value to your end users.

Gain a deeper understanding of your customers

-

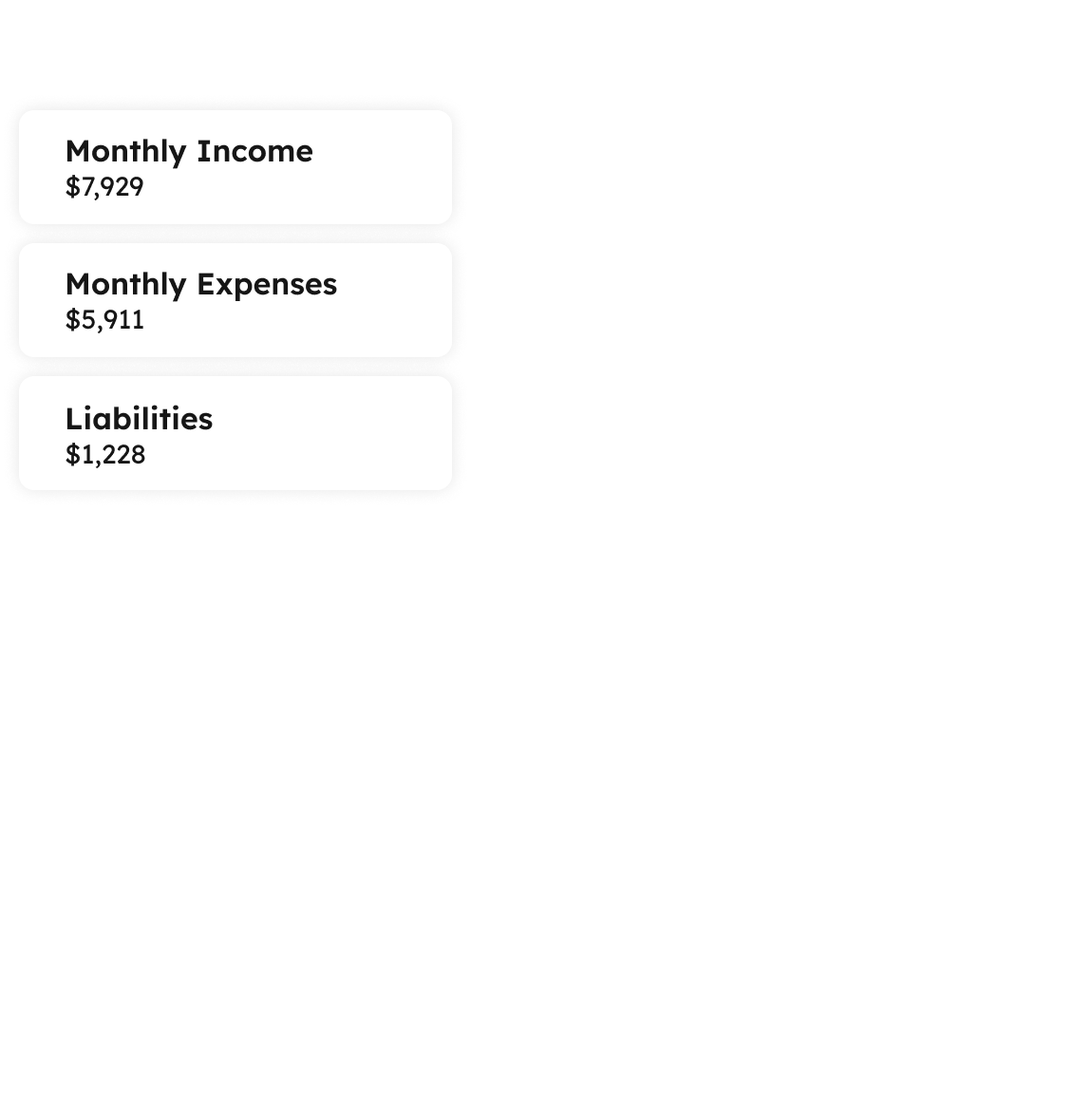

Affordability

-

Expenses

-

Income

-

Liabilities

-

Assets

-

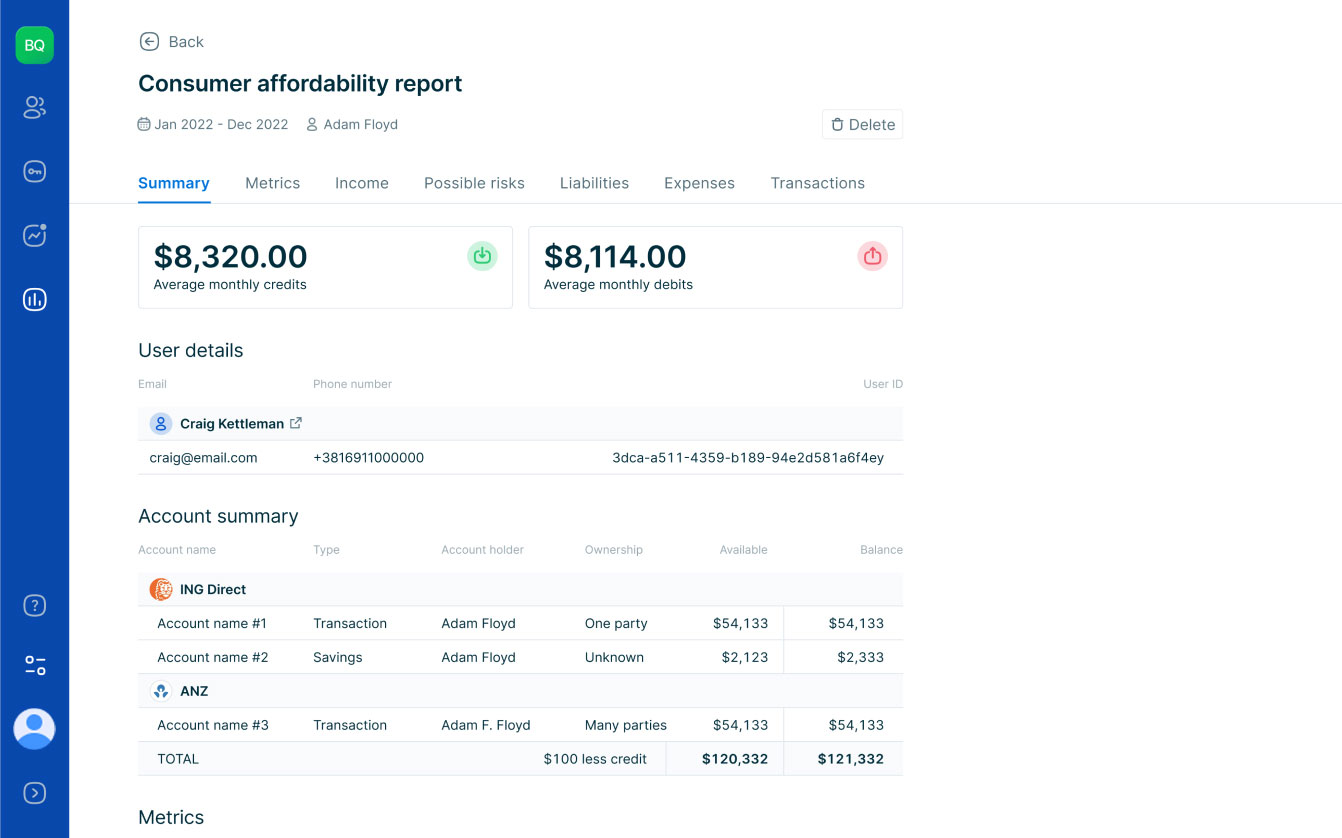

Affordability

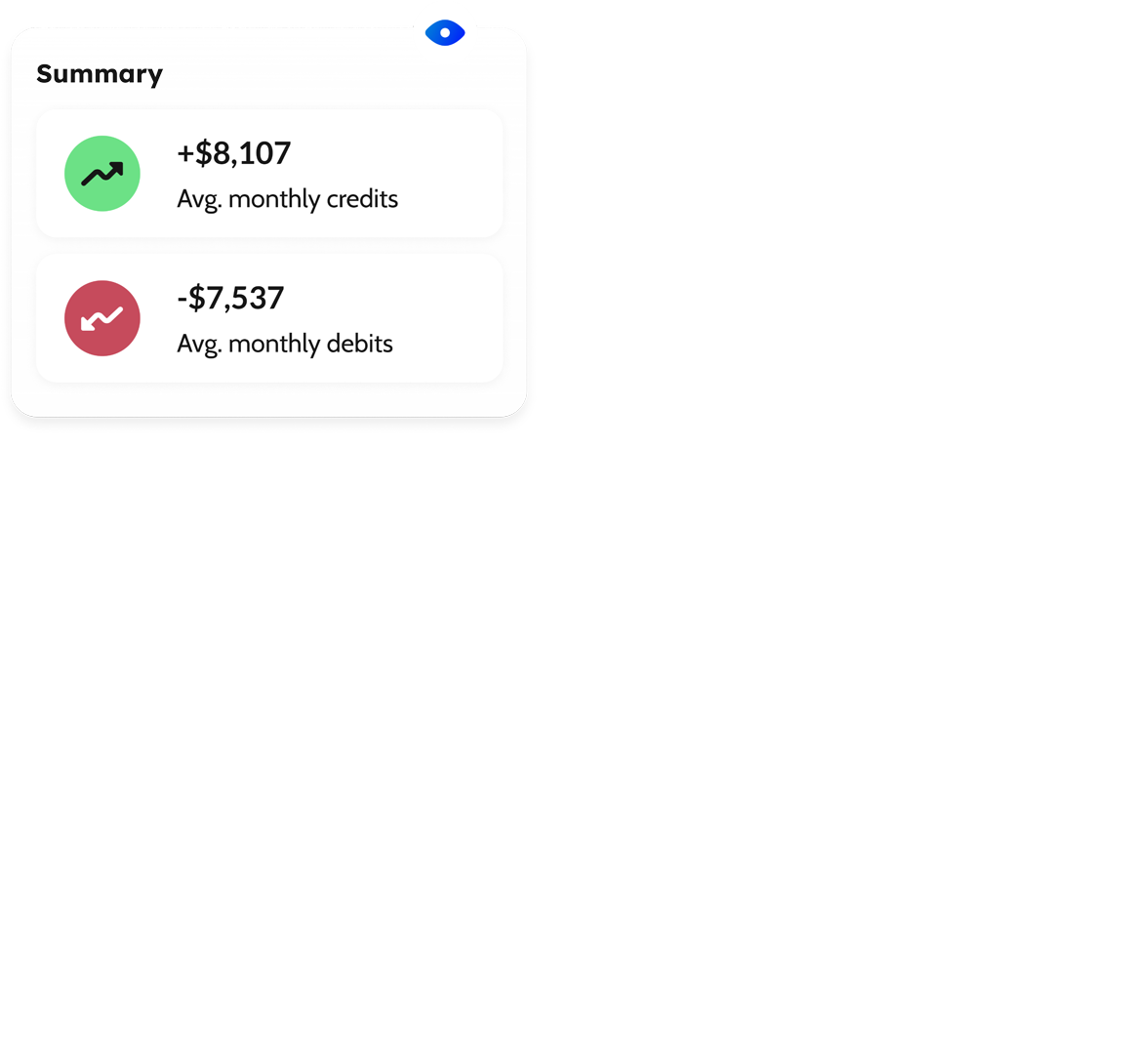

Complete picture of your customer’s financial position based on expenses, income, liabilities and assets.

-

Expenses

Generate a view of spend behaviour through an aggregated list of expenses with expense categorisation.

-

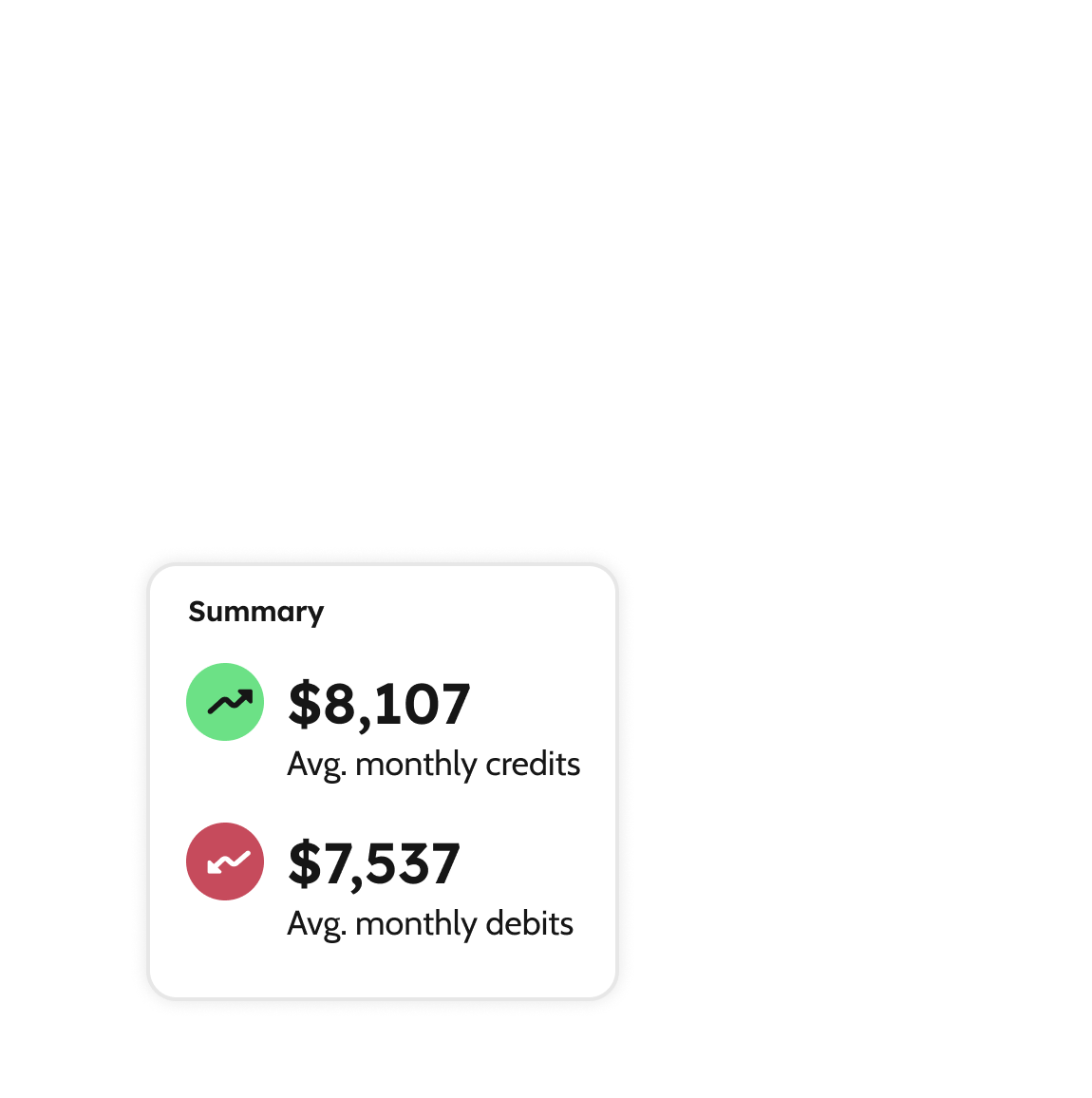

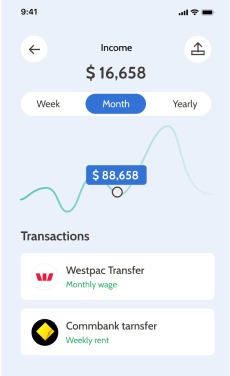

Income

Instantly identify income sources and get a complete view of income across all connected accounts.

-

Liabilities

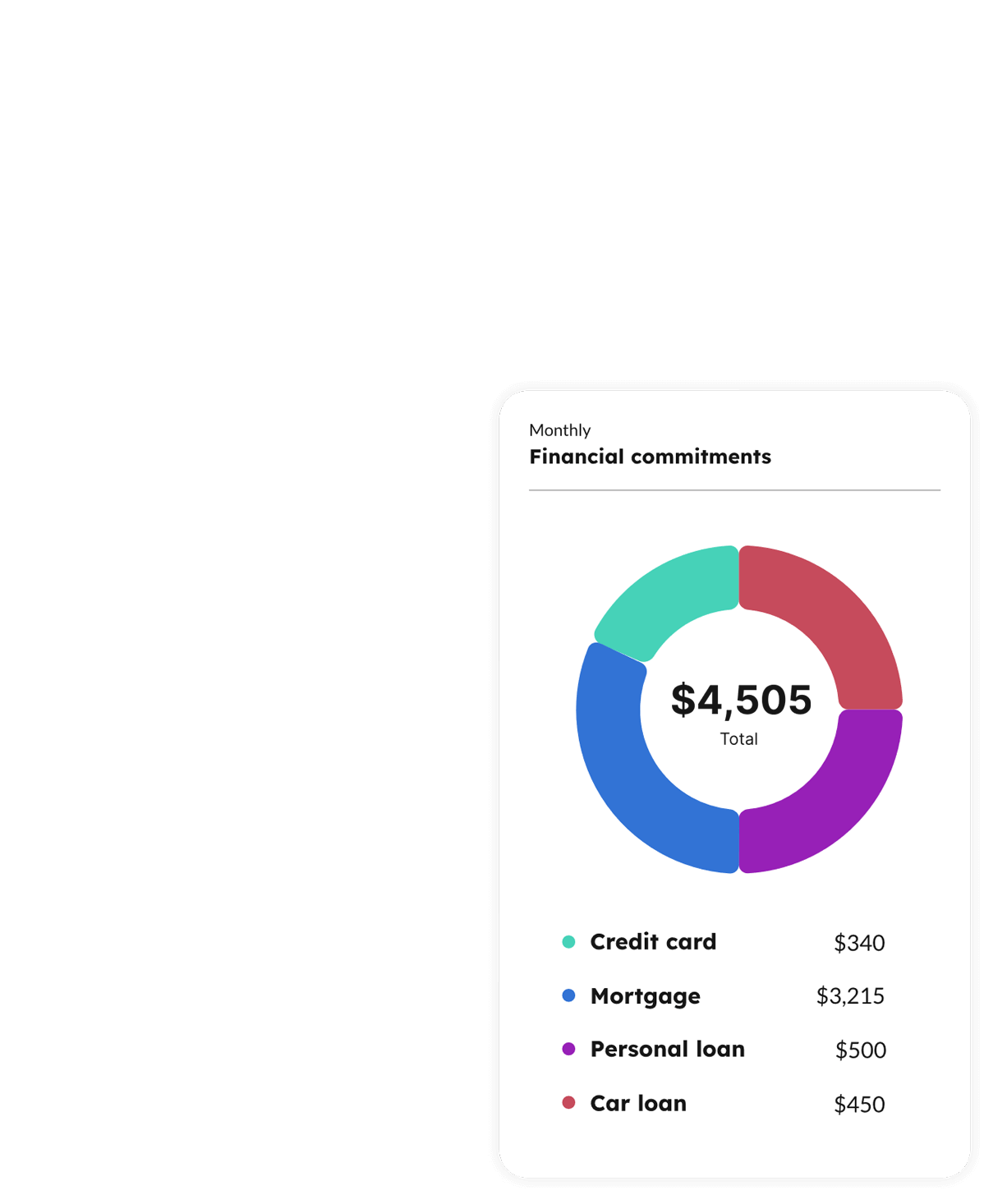

Gain insight into a user’s liabilities across mortgages, loans, credit cards and other financial instruments.

-

Assets

Generate a snapshot of a user’s assets across banks, superannuation funds and other financial institutions.

-

Uncover a complete financial picture of your customer

Gain a deeper understanding of the true nature of transactions, financial commitments, income sources, expenditure categories, and much more.

Utilise these insights to help streamline credit decisions, provide personal financial management tools, and onboard tenants for property leasing.

Learn more-

Home loan

-

Mortgage balance

-

Minimum repayment

-

Credit Card

-

Outstanding balance

-

Monthly repayment

-

-

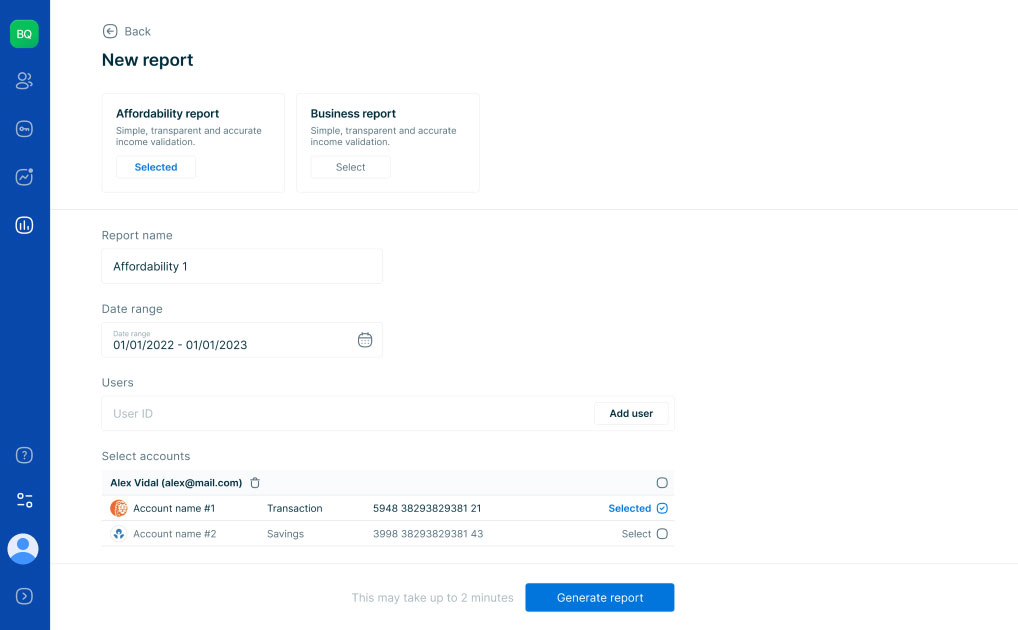

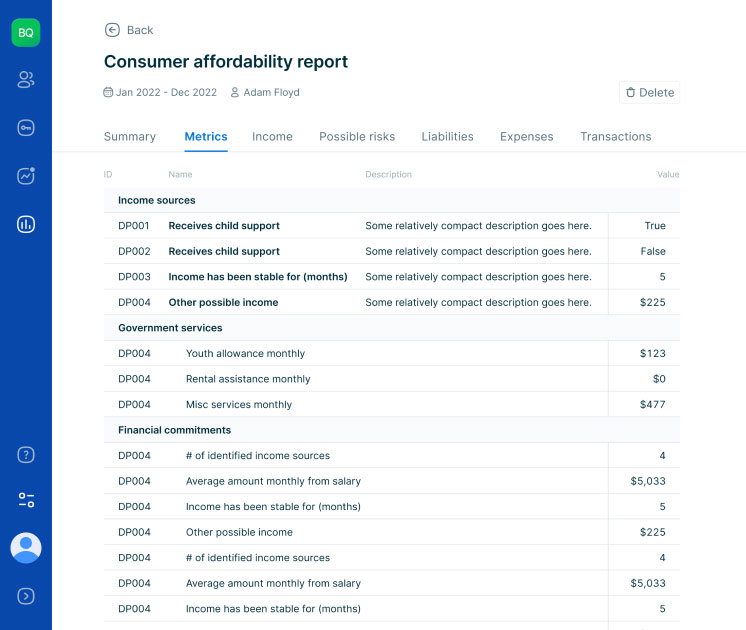

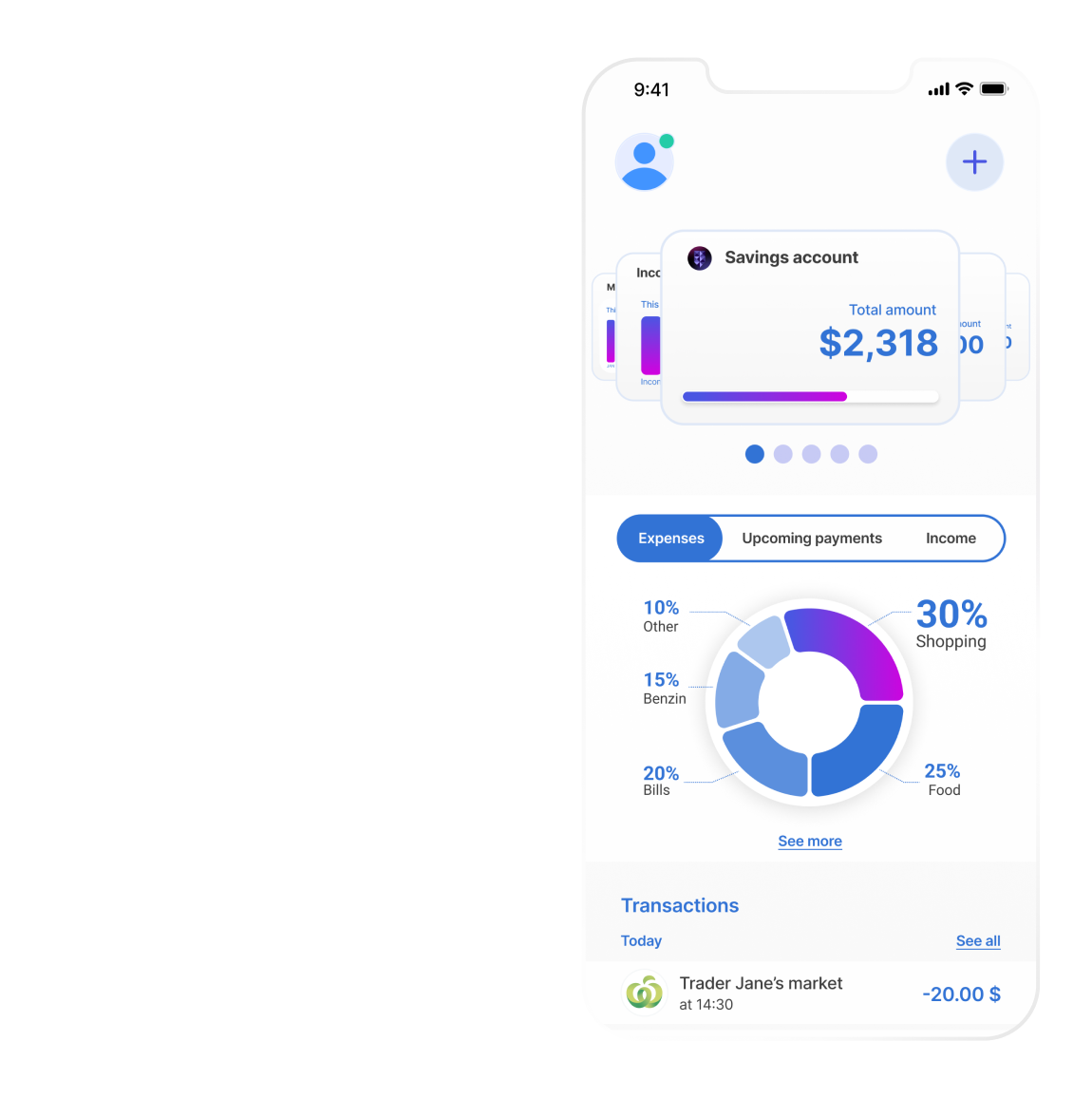

Configure insights

that you needWe understand that different businesses require different data points for their specific use case. To provide greater flexibility in accessing insights, we have curated a library of more than 300 attributes and metrics that can be used to generate customised reports according to your unique requirements.

Learn moreUpcoming Bills

-

Electricity

-

Gas

-

Subscriptions

-

Mobile & Internet

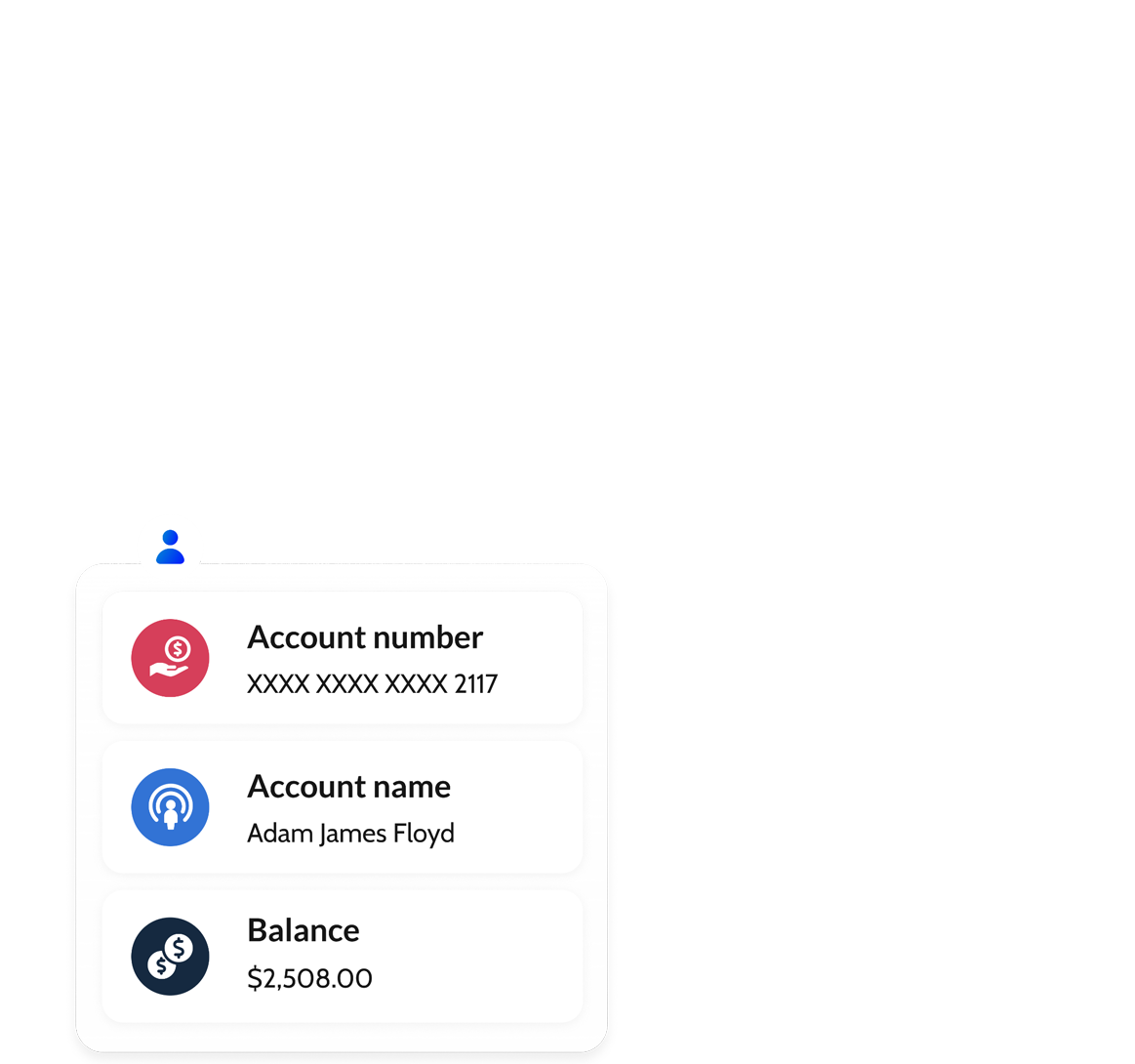

Balance

$2,931

Subscriptions

$82

Leisure

$439

Transport

$651

Food

$281

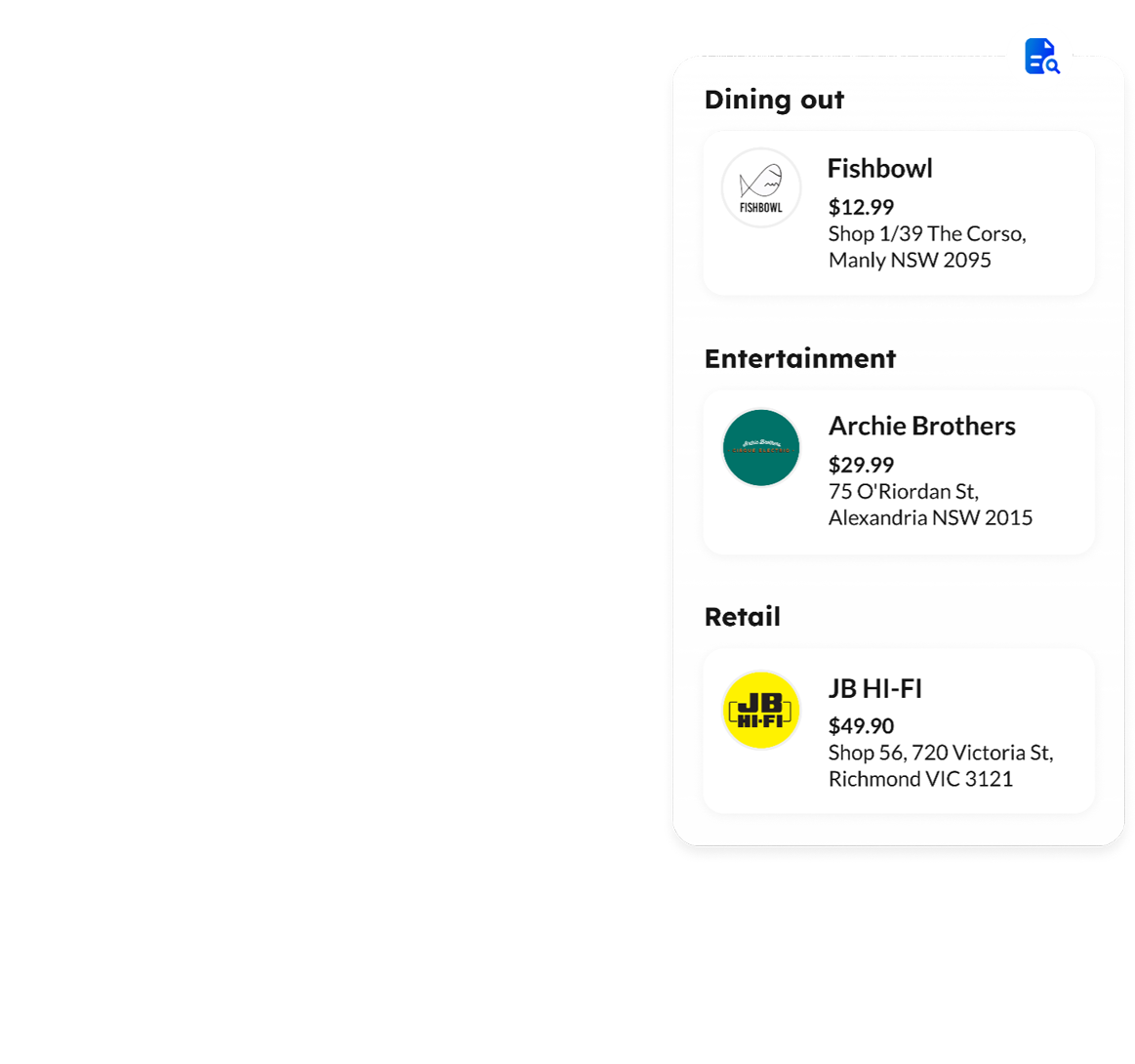

Unmatched depth with Data enrichment

Obtain enriched transaction details such as merchant, location, and category of each expense transaction. Accurately categorise living expenses into more than 500 categories based on ANZSIC classifications to gain a comprehensive understanding of spend behaviour.

Learn moreDining out

Fishbowl

$12.99

Shop 1/39 The Corso,

Manly NSW 2095

Entertainment

Archie Brothers

$29.99

75 O'Riordan St,

Alexandria NSW 2015

Retail

JB HI-FI

$49.90

Shop 56, 720 Victoria St,

Richmond VIC 3121

-

Uncover a complete financial picture of your customer

Gain a deeper understanding of the true nature of transactions, financial commitments, income sources, expenditure categories, and much more.

Utilise these insights to help streamline credit decisions, provide personal financial management tools, and onboard tenants for property leasing.

Bank statements

Empowering faster & compliant lending decisions.

Complementing our insights solution, bank statements provide a seamless and efficient way to generate compliant statements that can be shared with banks for lending approvals. Featuring customisable date ranges, logical running balance, institution branding and more, to optimise lending approvals.Built for developers

Get a head start with our developer guides, and make your first call to our APIs within a few minutes. Simple to use, RESTful, and fully documented APIs that help you integrate seamlessly with your application. Our intuitive sandbox allows you to test your apps before going live.

Get started

{

curl --request POST \

--url https://au-api.basiq.io/reports \

--header 'accept: application/json' \

--header 'authorization: Bearer {token}' \

--header 'content-type: application/json' \

--data '

{

"reportType": "CON_AFFOR_01",

"title": "John Smith Affordability Report 2022-03-26",

"filters": [

{

"name": "fromDate",

"value": "2022-01-01"

},

{

"name": "toDate",

"value": "2023-01-01"

},

{

"name": "accounts",

"value": [

"ag829sj",

"aj82gka"

]

},

{

"name": "users",

"value": [

"272af9fa-0f4a-44dc-bf88-a63bec2d0662"

]

}

]

}

{

"type": "job",

"id": "b1824ad0-73f1-0138-3700-0a58a9feac09",

"links": {

"self": "https://au-api.basiq.io/jobs/b1824ad0-73f1-0138-3700-0a58a9feac09"

}

Developer quick start guides

Everything you need to successfully integrate with the Basiq API.

Learn more