Get access to Open Banking data

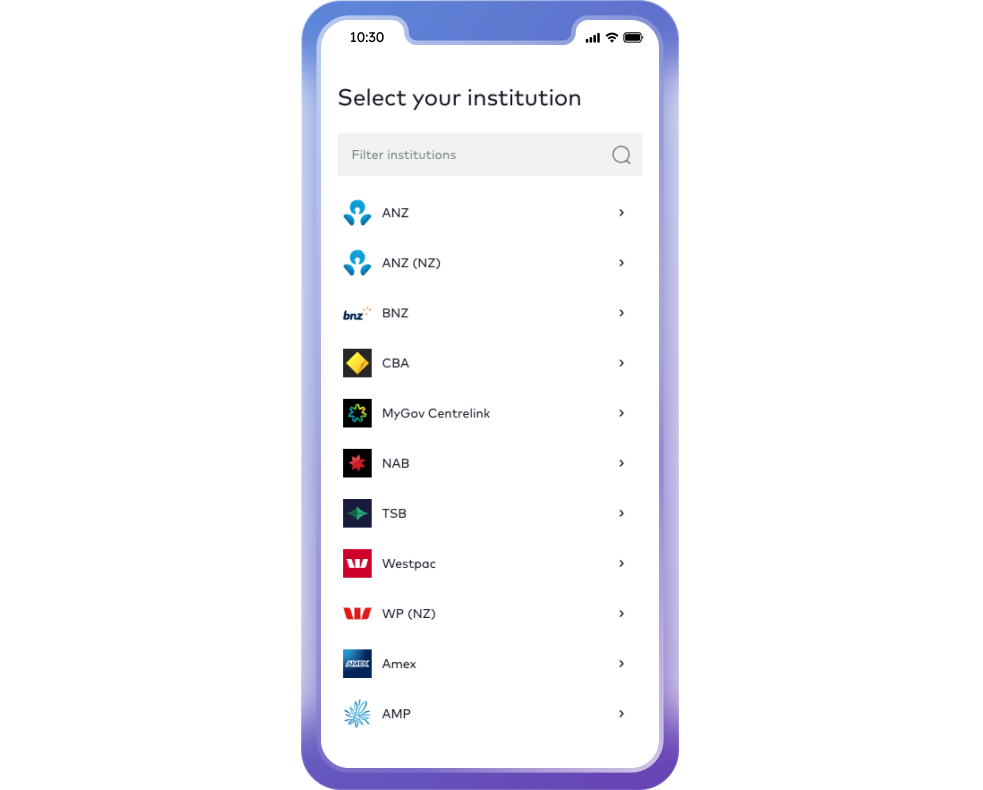

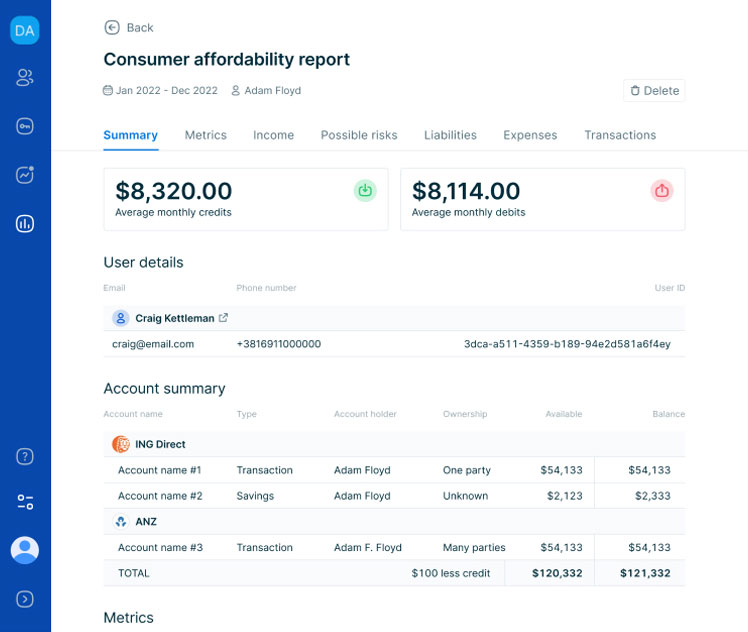

Access powerful tools and services to unlock the full potential of Open Banking and other sectors under the Consumer Data Right (CDR). Our platform provides a comprehensive suite of resources, coupled with a robust security and compliance program to guide you through the optimal path.

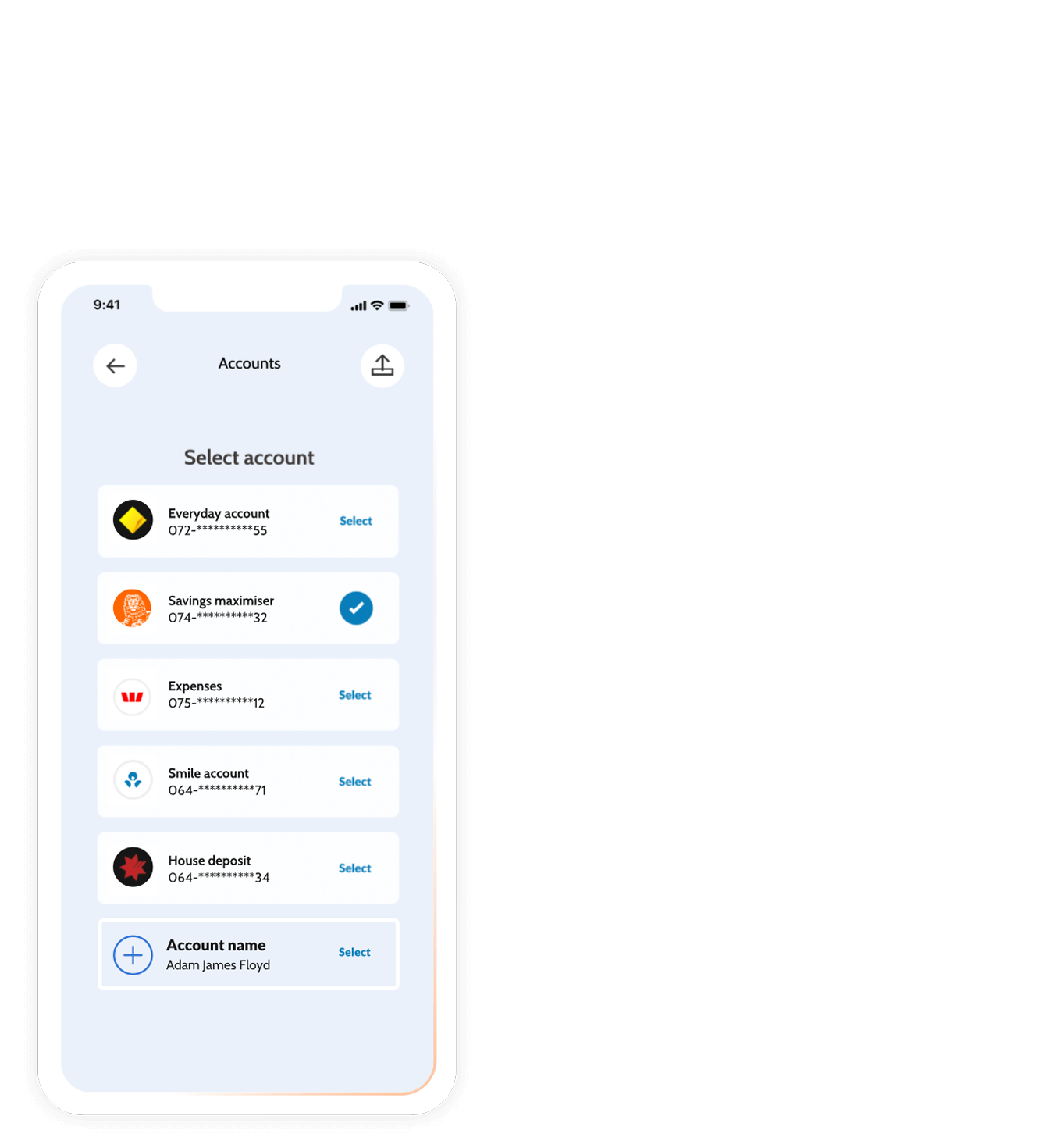

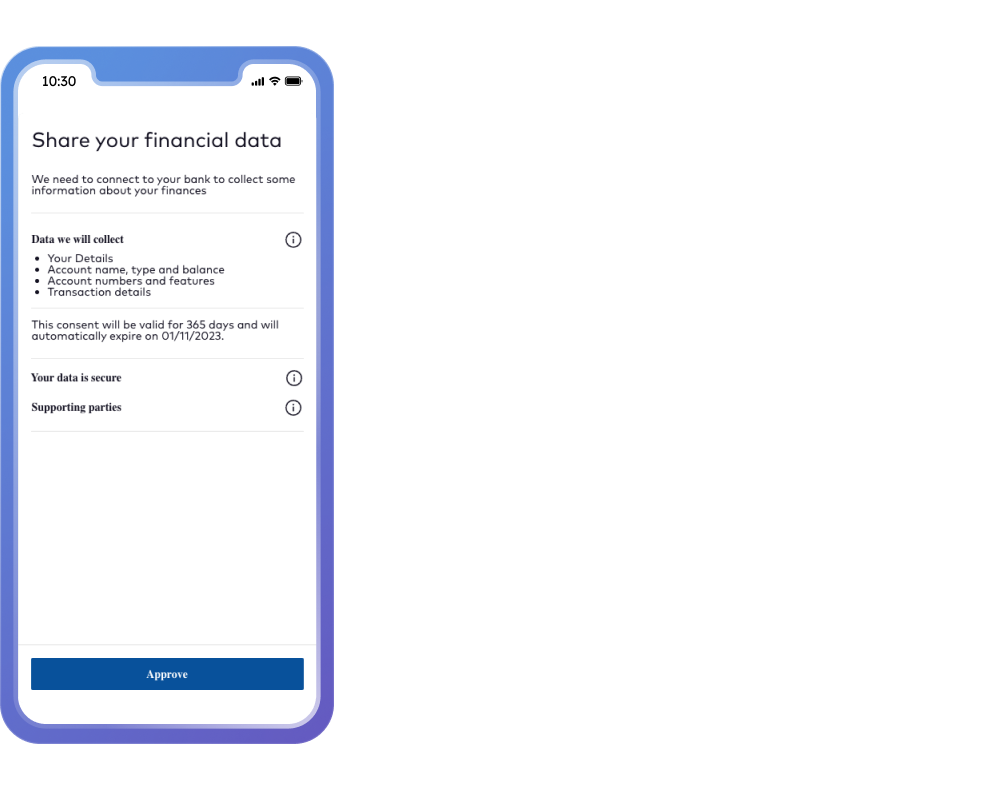

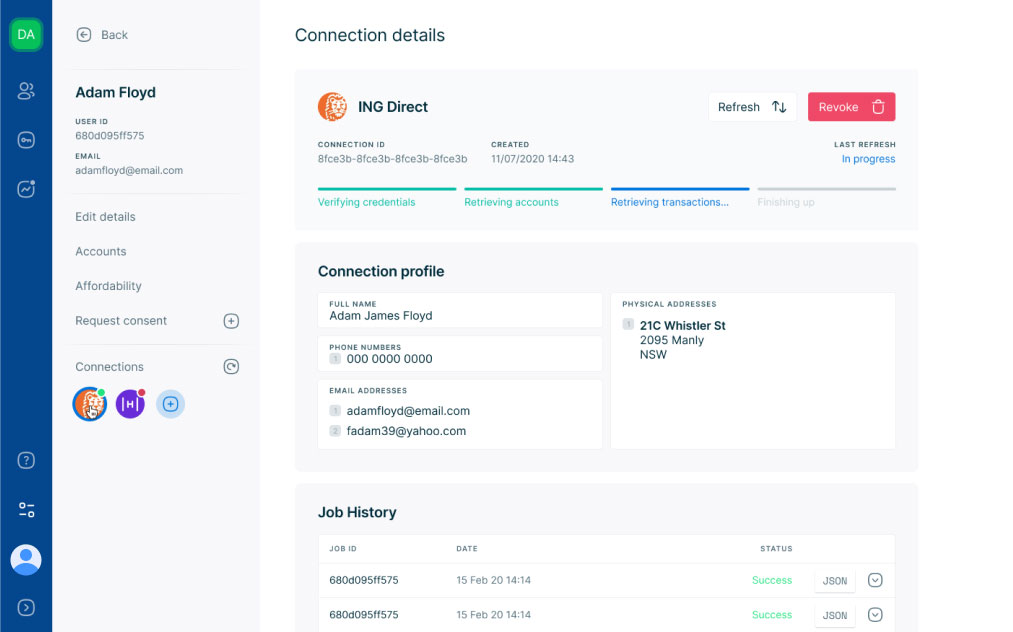

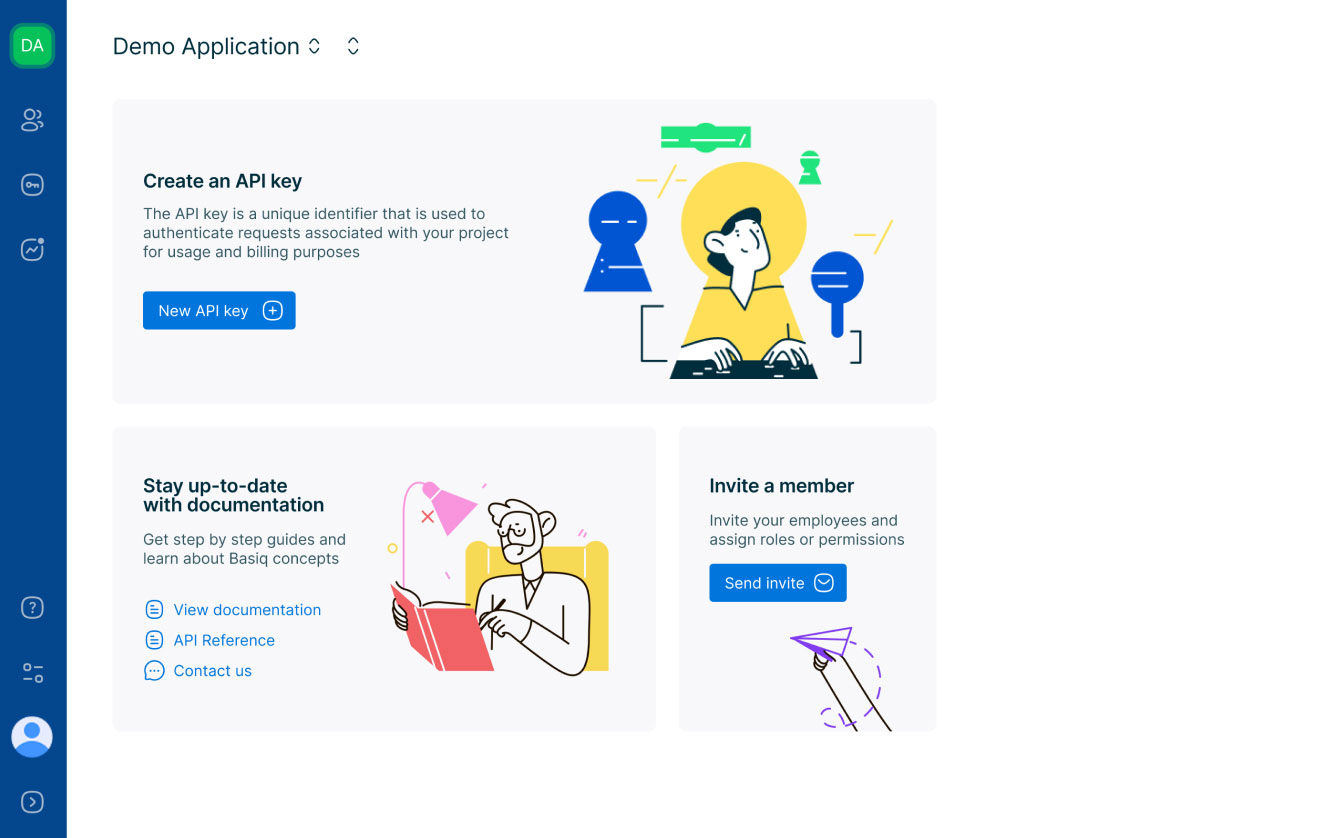

Take advantage of our Consent UI solution, Starter kits, and Developer dashboard and understand the various access models to accelerate access to CDR data.