Unlock the potential of Open Finance

Connect your product to your users’ financial data easily and securely through a single platform. Access a variety of data sources including Open Banking to build engaging experiences your users will love.

- Questions?

- Contact our sales team

One platform to rule them all

All the tools you need to build your application

-

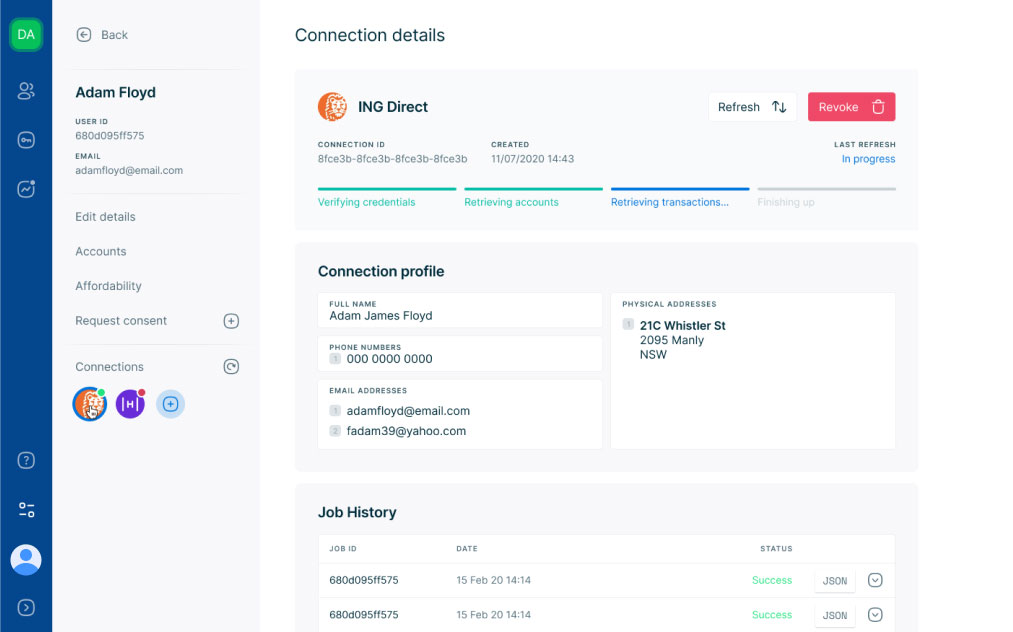

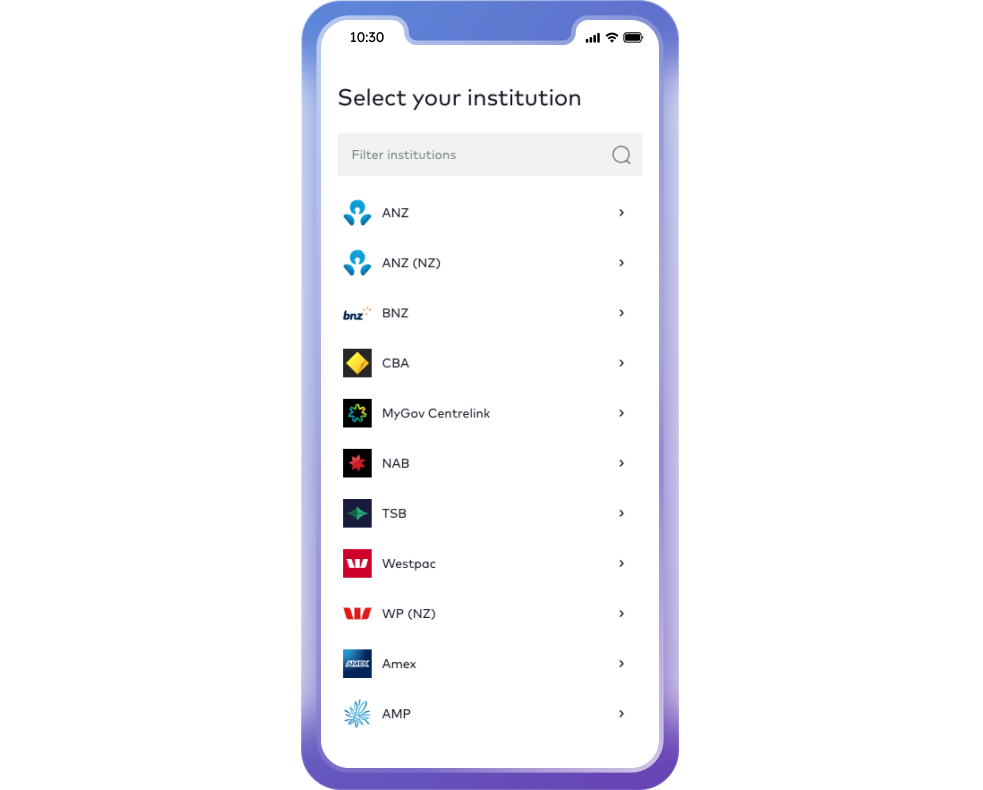

Data

Get access to data from banks, other financial institutions including superannuation & energy providers. With access to information including accounts and transactions through Open Banking, get the most complete picture of end users to launch your application.

Learn moreTransactions

-

Hungry Jack’s

-

Deliveroo

-

Income from Apollo Group

-

BP Fuel

-

Uber

-

-

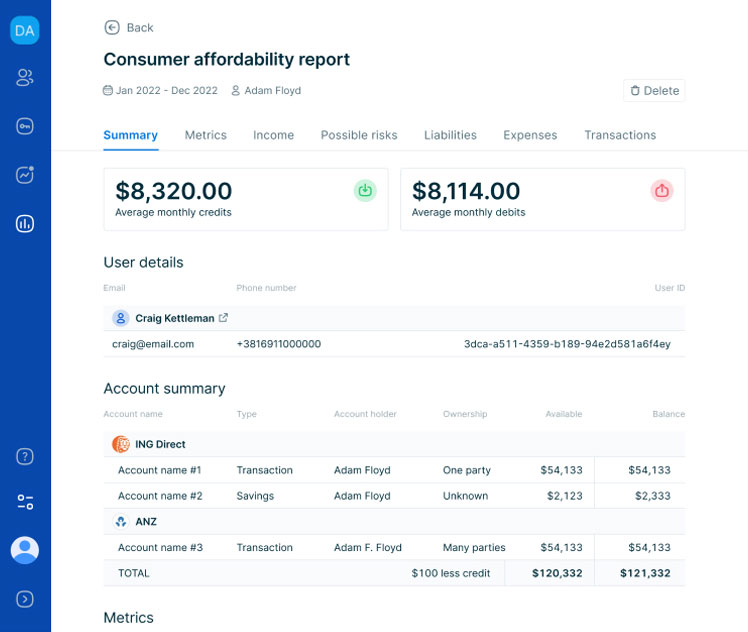

Insights

Identify specific patterns and trends from financial data such as income, expenses, assets and liabilities. Generate affordability insights to get a comprehensive view of end users.

Learn moreSummary

Metrics

-

-

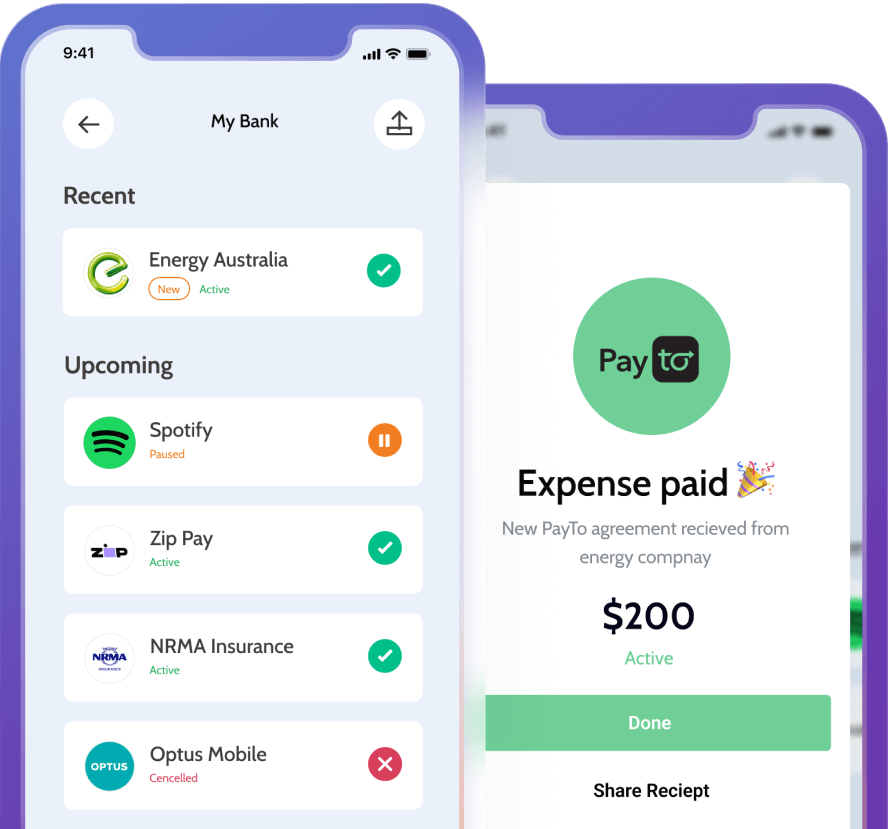

Data holder

Meet requirements of the CDR with a comprehensive data holder solution encompassing authorisation, compliance, consent management, security and ongoing reporting.

Learn more

Australia’s leading Open Banking platform

If you’re looking to get access to Open Banking, we’ve got you covered. Basiq provides all the knowledge and tools you need to access and use Open Banking data. Learn more at Basiq’s Open Banking hub.

Consumers

have shared their data through the

Basiq platform

Organisations

have accessed data through the

Basiq platform

Data Sources

covering all major institutions with access

to 99% of the AU & NZ population

Explore Use Cases

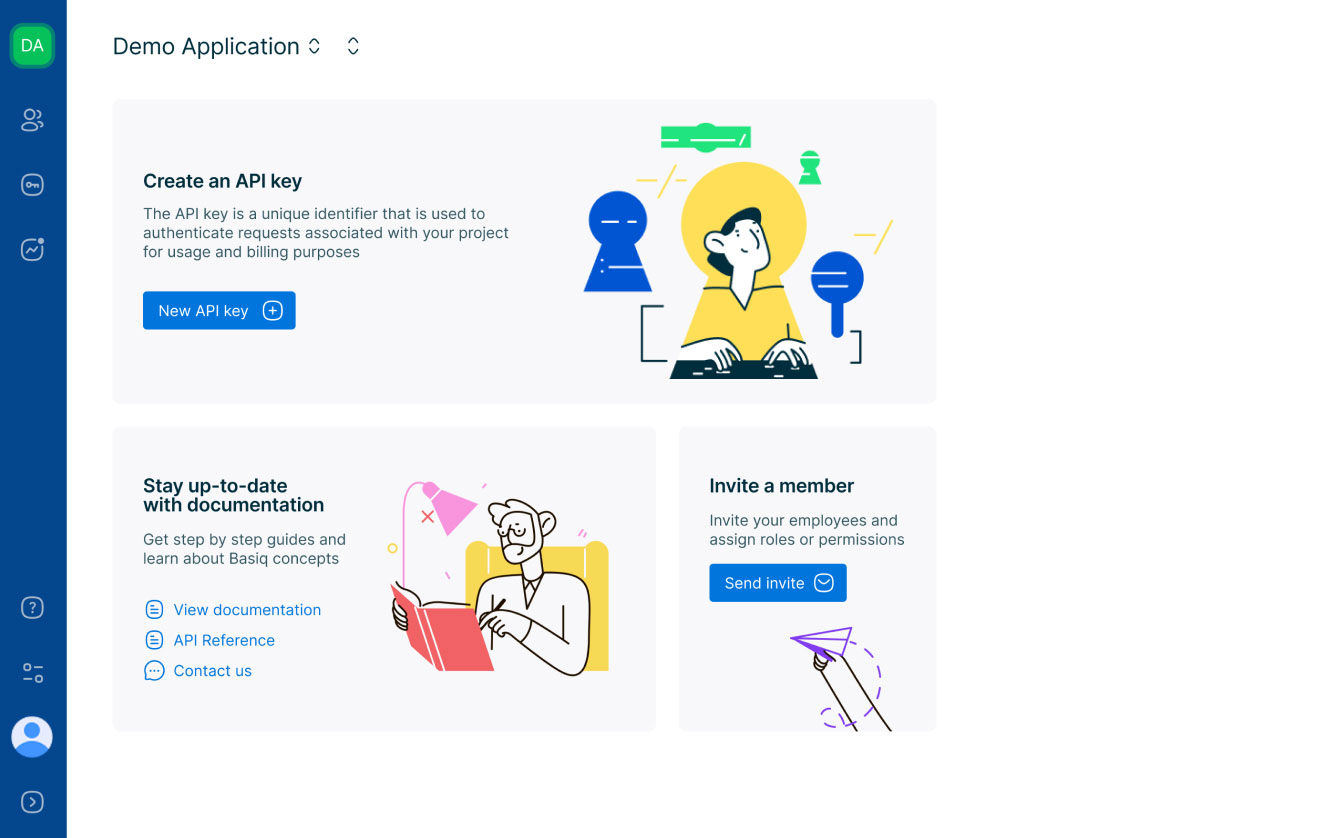

Developer Friendly Open Banking APIs

Built for developers

Get a head start with our developer guides, and make your first call to our APIs within a few minutes. Simple to use, RESTful, and fully documented APIs that help you integrate seamlessly with your application. Our intuitive sandbox allows you to test your apps before going live.

Get started

{

curl --request GET \

--url

https://au-api.basiq.io/users/d65a5499-cbc7-49b7-9f47-d30ea367ee13/accounts/465a5499-cbc7-49b7-9f47-d32ea367ee13

\

--header 'accept:

application/json' \

--header

'authorization: Bearer {token}'

Submit >

{

"type": "account",

"id":

"s55bf3",

"accountHolder": "GAVIN

BELSON",

"accountNo":

"600000-157441965",

"availableFunds":

"420.28",

"balance":

"356.50",

"creditLimit":

"400000.00",

"class": {

"type":

"mortgage",

"product": "Hooli Home

Loan"

},

"connection":

"8fce3b",

"currency": "AUD",

"institution":

"AU00000",

"lastUpdated":

"2019-09-28T13:39:33Z",

"name": "Master

Savings",

"status":

"available",

"transactionIntervals": [

{

"from": "2018-07-01",

"to": "2018-12-30"

}

],

"links": {

"institution":

"https://au-api.basiq.io/institutions/AU00000",

"transactions":

"https://au-api.basiq.io/users/ea3a81/transactions?filter=account.id.eq('s55bf3')",

"self":

"https://au-api.basiq.io/users/cd6fbd92/accounts/319ae910"

}

Developer quick start guides

Everything you need to successfully integrate with the Basiq API

Read docs

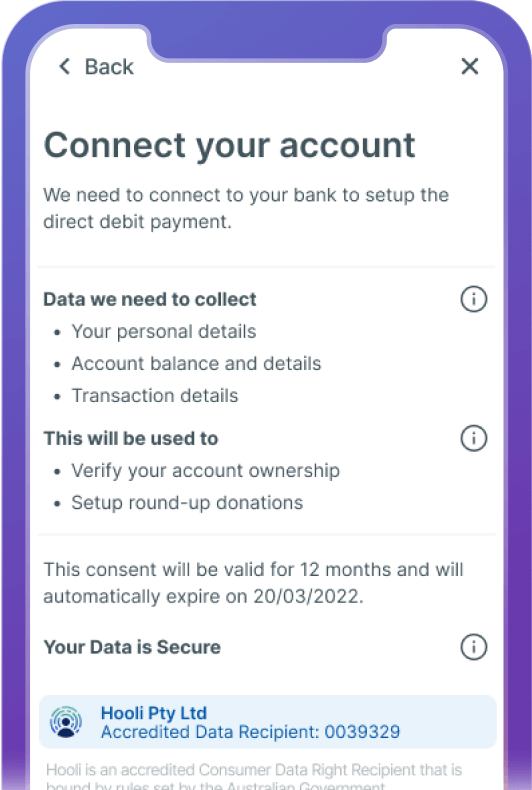

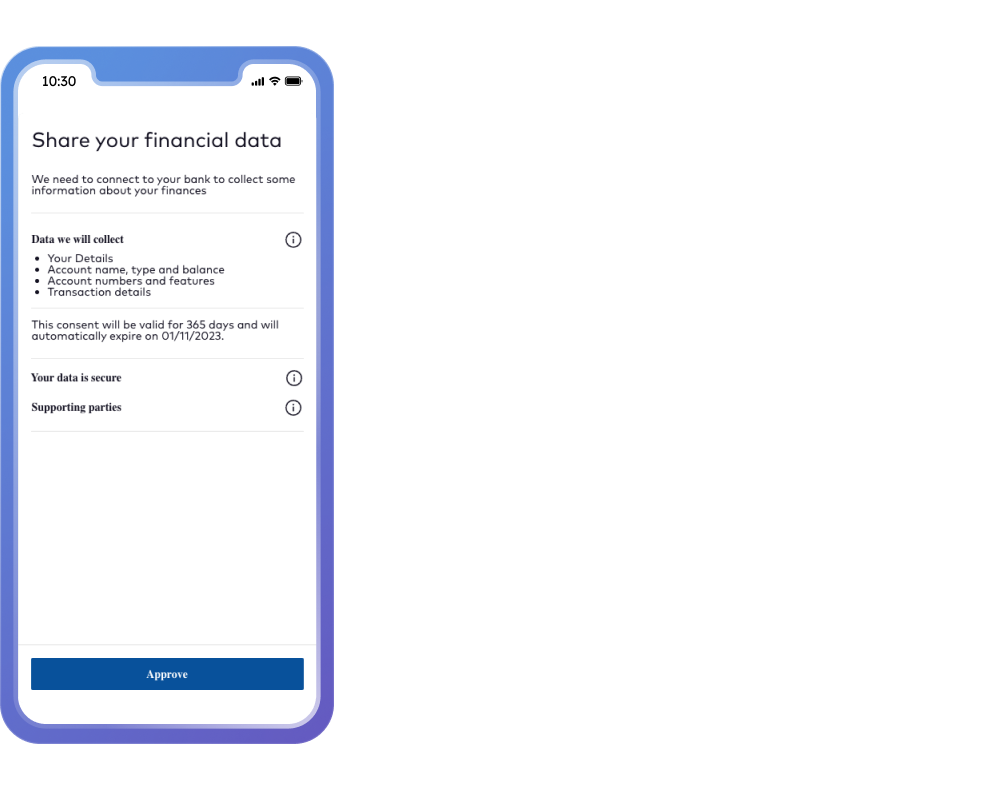

Easy to use consent solution

Reduce development costs and accelerate time to market with an out of the box consent UI. Create a more native experience and easily integrate into your application.

-

Define data scope and purpose of collection

-

Manage consent policies and dynamically generate the UI

-

Configure branding, styling & content elements

-

Integrate analytics to optimise user journeys

-

Preview changes in editor before going live

Ready to get started with Basiq?

Get in touch with one of our team members or create an account