Why we focus on your customer’s experience

Most of our partners have a B2C business model and this means they probably have an App or maybe a web App to serve their customers. Ten years ago if you had used the term CX or customer experience you would likely have been met with blank looks. These days it is practically a household term and something we all strive for in our customer interactions.

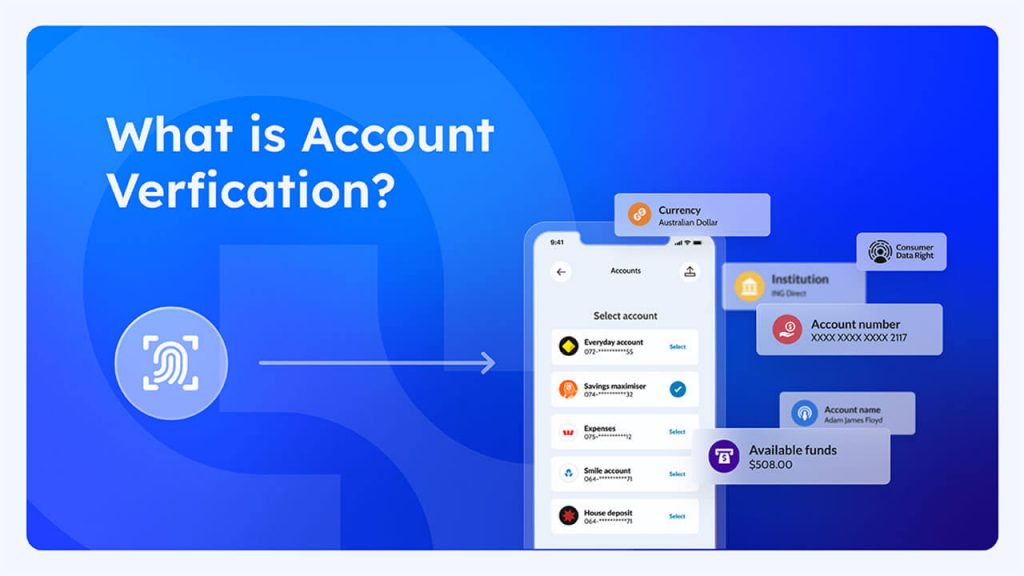

At Basiq, as an API platform we focus on our ‘customers’ and we talk about Developer Experience. However that does not mean we don’t think about your customers and their UX and CX. Our platform enables you to instantly gain a relationship with a new customer through their financial history. This enables you to instantly form a solid CX foundation.

We also think about your customers user experience (UX) and we have a few enhancements to the platform we would like to announce.

New customer onboarding retry

As many of you know, the process of creating a new user and connecting their financial institutions to the Basiq platform is split into several stages:

- Select institution, provide login credentials and authenticate

- Retrieve Account and related metadata

- Retrieve Transactions

But what if Basiq is not able to authenticate (stage 1)? This could be due to the institution having an outage or a problem with the interaction between Basiq and the institution. The answer used to be, a user would be asked to “try again later”, this is no longer the case. The Basiq Platform will now trigger a long term queuing mechanism that will retry the authentication periodically for up to 7 days. This means the UX can now be “there is an outage but don’t worry, we will work it out for you”.

The need for speed!

The biggest factor when onboarding a new user is success rate. If you can’t complete the onboarding process, you are guaranteed onboarding will fail. For this reason Basiq continuously works hard to improve success rates with our connectors.

The second biggest factor that affects your onboarding UX and ultimately your CRO is speed. The longer a user needs to wait for a process to complete, the higher the likelihood of them abandoning the process. You can handle this with a good UX that explains the process and the expected delay and also engages the user or enables them to proceed with other tasks. We can improve the UX by being faster.

We have been working on several optimisations to enable all 3 stages of the connection process to run faster.

Accounts optimisation for several major banks

We recently undertook connector optimisations across a few of the major banks. This optimisation focused specifically on the accounts step in the data retrieval process. Below is an example of just one of the connectors. Yes you are reading that chart correctly a +65% improvement!! The accounts step has been improved and on average executes in under 10 seconds! Keeping in mind that there is still a step before and after accounts, this improvement is fantastic news for our customers.

We have implemented similar changes across several other major banks and have seen similar improvements and we are in the process of analysing each connector to see if the same changes can be made (each connector is unique). Basiq is continuously looking at ways to improve not just our connectors but our platform as a whole, so stay tuned for future updates and announcements.

To keep up to date on the latest product news make sure to subscribe to the Basiq blog.

If you’re building a Fintech solution and need ongoing access to banking data, get in touch with our team to see how Basiq can help.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.