Basiq Insights, a level up for lenders

We are proud to announce the launch of our improved affordability solution – Basiq Insights. Leveraging a variety of data sources including Open Banking, our uplifted Insights solution offers a holistic approach to financial data analysis and decision making in the lending industry by bringing together the power of Basiq’s API with the simplicity of a no-code dashboard.

Navigating the complexities of modern lending

In today’s rapidly evolving financial landscape, lenders face a multitude of challenges that can hinder their efficiency and effectiveness. From the intricacies of regulatory compliance to the need for technological agility, these challenges demand innovative and adaptable solutions. Basiq Insights emerges as a pivotal tool in addressing these complexities. Let’s explore some of the key challenges in the lending space and how Basiq Insights provides effective solutions:

- Manual Assessments and Accuracy Issues: Automated solutions reduce the reliance on manual methods, enhancing accuracy and security.

- Disjointed Customer Experience: Streamlined data processing improves the customer journey in loan applications.

- Navigating Regulatory Obligations: Compliance becomes more manageable with automated data handling and open banking integration.

- Overcoming Technological Limitations: The combination of API and no-code dashboard ensures that lenders are not left behind due to outdated tech stacks.

- Screen scraping regulations: With Treasury considering the ban of screen scraping of financial data from bank accounts. Lenders using decisioning platforms that solely rely on screen scraping will be left without access to their customers’ financial information as banks move to use Open Banking.

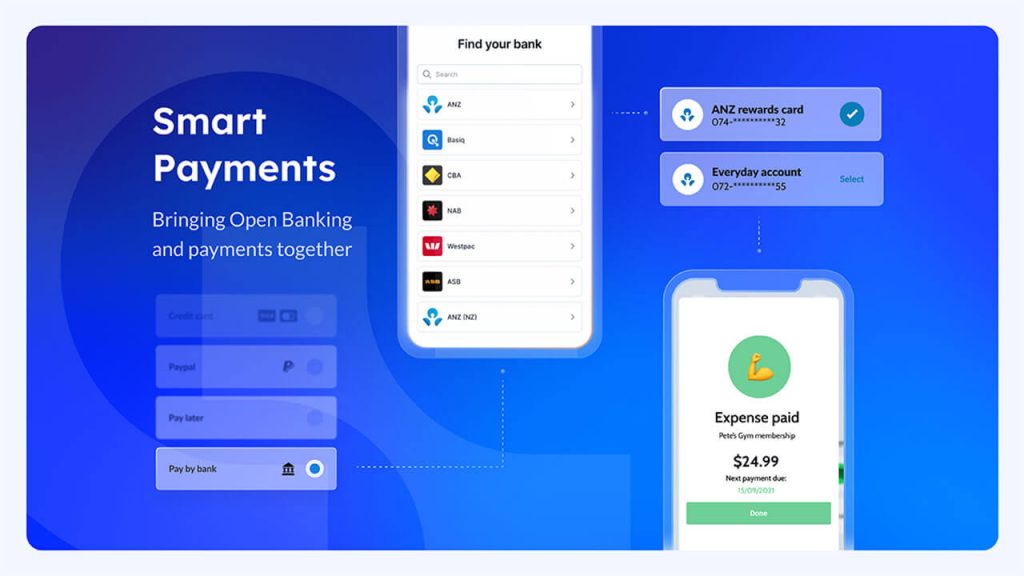

Powerful APIs for bespoke decisioning

Basiq’s API forms the backbone of the affordability solution, allowing lenders to delve deep into financial data with enriched transaction details, ensuring precise and reliable insights tailored to their specific needs.

It is an unparalleled tool, empowering you to create bespoke decision making for your customers that align with your specific use case. It boasts the most comprehensive library of data points, metrics and categories available in the market, enabling you to go beyond using templated reports from conventional providers.

Basiq’s No-Code Dashboard – empowering teams beyond development

The no-code dashboard revolutionises the experience for non-developer teams. Designed for seamless integration with the API or as an independent solution, it simplifies interaction with Basiq’s robust reporting API. The dashboard provides access to data aggregation, enrichment, and insights, all without requiring specialised coding skills or the development of custom applications. Its user-friendly interface bridges the gap between complex data handling and operational ease, enabling you to focus on creating value for your end users.

Key features of Basiq Insights: Consumer Affordability reporting solution

Across the Basiq API and Dashboard you can access a range of features and capabilities.

- Access to data from CDR, Web connectors & Uploads: Future proof your solution by accessing web connectors (screen scraping) and Open Banking via a single platform. Be prepared to make the switch when banks transition away from screen scraping and leverage even more data insights with Open Banking.

- Extensive data library: Includes thousands of data points, over 60 groups, 50+ metrics, and more than 500 merchant categories, continually updated for comprehensive reporting.

- Comprehensive transaction data access: Offers access to over 12 months of transaction data from various financial institutions, providing a detailed view of a customer’s financial health.

- Advanced data categorisation: Features enriched transaction details, including merchant, location, and category, with expenses categorised into more than 500 categories based on ANZSIC classifications for detailed spend behaviour analysis.

- Customisable reporting: Allows for the generation of customised reports to meet unique decisioning criteria using a growing library of data points and metrics.

- Enhanced decisioning tools: Includes a continuously expanding set of groups and metrics to refine decision-making processes.

- Consolidated multi-account reporting: Integrated consent UI enables consolidated reporting across multiple bank accounts, allowing for individual or combined reports for multiple applicants.

- Predefined Risk Flags: Benefit from our extensive library of risk flags, meticulously designed for comprehensive decisioning. These predefined flags are instrumental in identifying gaps in financial information, ensuring thorough and accurate assessments in your lending processes.

- Powerful enrichment overlay services: Utilises machine learning for transaction cleansing and categorization, enhancing data quality for deeper insights.

- Export options: Provides the ability to export reports in PDF or CSV formats for record-keeping and detailed transaction analysis.

- Bank statement export capability: Enables easy export of bank statements to support lending decisions.

Transforming lending with Basiq Insights

Basiq Insights stands as a beacon of innovation in the financial sector, particularly in the realm of lending. Seamlessly blending the technological prowess of its API with the accessibility of a no-code dashboard, this solution not only meets the current demands of the lending industry but also anticipates its future needs.

Basiq Insights is not just a tool but a comprehensive solution, tailored to meet the diverse needs of the modern lending landscape. With its array of advanced features, it offers unparalleled depth and breadth in financial data analysis and reporting across its API and No-Code Dashboard solutions. Here’s a look at some of the key features that make Basiq Insights a leader in its field:

- Enhanced Loan Processing Efficiency: Automation and real-time data access lead to faster and more accurate loan decisioning.

- Data Enrichment and Classification: Enhanced transaction details for precise financial assessments.

- Customer Consent Management: Ensuring data privacy and compliance.

- Tailored Financial Insights: Customisable options for specific lending needs.

- Superior User Experience: A streamlined and intuitive interface for both lenders and their customers.

- Automated Data Aggregation and Insights: Streamlines operational processes.

- Compliance with Regulations: Particularly beneficial in the Australian banking sector.

- Improved Mortgage Pre-Approval Processes: Ongoing consent and open banking facilitate quicker pre-approval renewals.

The robust features underscore Basiq’s commitment to driving efficiency, accuracy, and user satisfaction. More than just a tool, Basiq Insights is a strategic ally for lenders, empowering them with the data and insights needed to navigate the complexities of the financial landscape. With a forward-thinking approach to data privacy, regulatory compliance, and user experience, Basiq Insights is setting a new standard for consumer affordability solutions. As the lending industry continues to evolve in this digital age, Basiq Insights is undoubtedly leading the charge, paving the way for smarter, faster, and more customer-centric lending practices.

Start your journey with Basiq Insights today

Ready to elevate your lending process with the cutting-edge capabilities of Basiq Insights? It’s time to harness the power of Open Banking and transform how you understand and serve your customers.

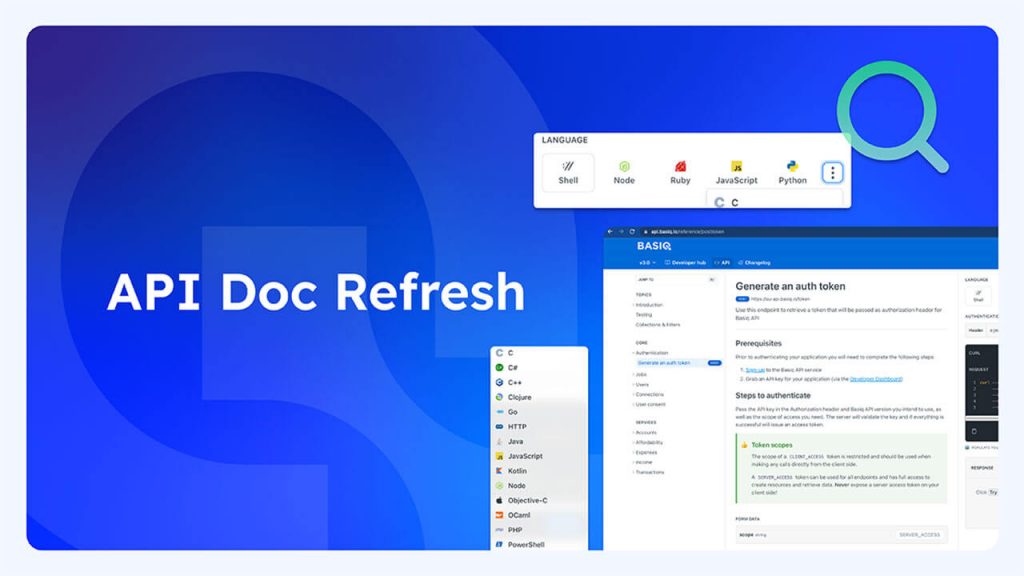

Explore the API: Create your FREE account now and begin experimenting in our sandbox environment. Experience firsthand how Basiq Insights can revolutionise your data analysis and decision-making processes. Read our API documentation here.

Discover the No-Code Dashboard: Want to see how our user-friendly dashboard can streamline your operations? Get in touch with our team for a detailed walkthrough and explore the possibilities.

Contact Us | Sign Up for a Free Account

Embrace the future of lending with Basiq Insights, where innovation meets efficiency and customer satisfaction.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.