“One app to rule them all, one app to find them, One app to bring them all together, and in the darkness upsell them; In the Land of Fintech where the opportunities lie.”

Image courtesy of NFKino

Intro

Welcome back to Instalment 9 of the Basiq Insights series. This penultimate edition of the series focuses on the “Super App”, aka ‘One App to Rule them All’. A Super App can be defined as: “a mobile application that provides multiple services including payment and financial transaction processing, effectively becoming an all-encompassing self-contained commerce and communication online platform”. (1) With the advent of rebundling, there’s a large land grab underway in the Australian Fintech world for an app that can offer a one-stop-shop for every feature that a B2C business is supplying. This article looks at what a ‘Super App’ is and how it reflects the rebundling movement.

Did a full 180, crazy

When the Basiq Insights series was started, it looked at how Fintechs are ‘Unbundling the Big Four’, aka how Fintechs start out by creating a single product that is better than one offered by a Bank, reached product market fit, then scale into an array of new products and services. The scaling part is also known as ‘Rebundling’, and in Australia we’ve seen it with a number of the BNPL players who have begun to offer a suite of new products in addition to their core (e.g. personal finance management, loyalty/rewards, savings accounts etc). This trend is not specific to Australia, but has been a global trend as the growth of Fintech has accelerated, with Asia being the pioneer of Super Apps through WeChat, AliPay and Meituan.

Inputs to Super Apps in Australia

When looking specifically at the Australian market, there are a number of inputs to the rise of the Super App. They are as follows:

1. Brand loyalty

As Fintechs become viable alternatives to Banks in Australia, those who provide fantastic customer experiences are likely to create stickiness within their customer base. Stickiness creates engagement, engagement creates a desire to (a) engage more with the product or service and (b) fertile ground for new product distribution.

2. Open Banking

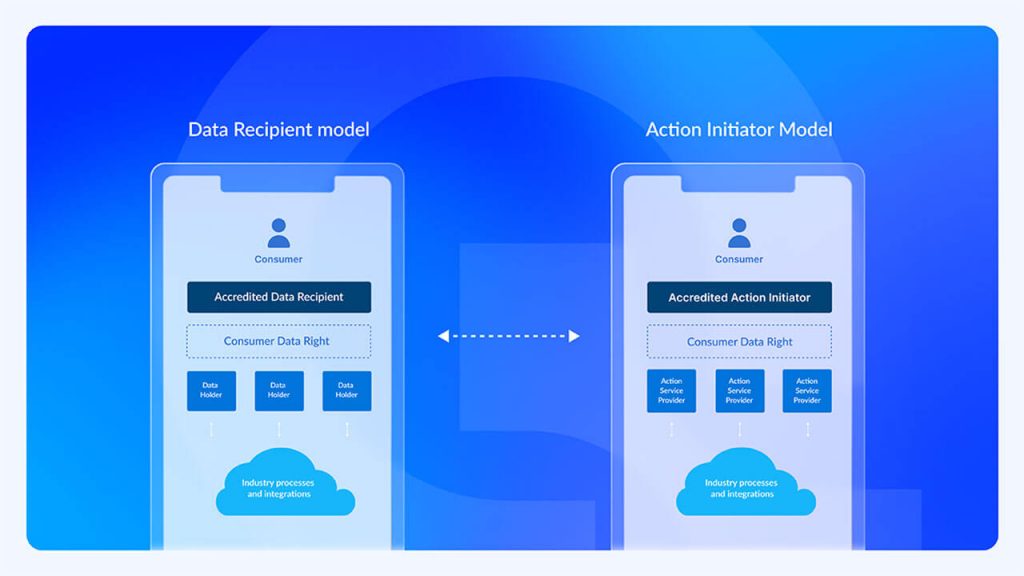

Open Banking is predicated on the liquidity of customer-consented data between financial institutions (and, down the line, all institutions e.g. telco, utilities). Open Banking allows for an app to ‘rebundle’ a product or service in a seamless manner, using the sophisticated consent frameworks laid out under the Consumer Data Right (CDR). Connecting or adding a new feature as part of a user’s ongoing consent policy means that the barriers to accessing user data are drastically lowered (Spaceship, for example, added a new ‘Boost’ feature using the Basiq platform which allowed for the rounding up of transactions and top ups when an external event occurs, such as a rainy day).

3. Speed to market

Fintechs are consistently delivering new features at a lightning-quick pace. This is a function of scalable + cloud-native architecture, talent, agile teams and flexible organisational structures (amongst many other things). Ultimately, it creates the ability to ship quickly, with product teams not limited by challenges incumbents face, such as legacy processes and architecture.

With this in mind, how do these three inputs vie for a slice of a consumer’s attention?

Super Apps and the Attention Economy

Attention economics treats a consumer’s attention as a commodity, realising that their consumption of information is a zero sum game. Therefore, the more time you can have someone engaging with your Fintech product or service, the more likely they are to continue to use you. It sounds self-evident, however in order to sustain a competitive level of engagement, the app needs to develop over time with consistent new features and updates in a non-invasive manner. You could argue this creates a Catch-22, whereby in order to acquire more users, you need more features, but in order to get more features, you need more users. Therefore, the aforementioned inputs into ‘Rebundling’ must be achieved before executing a ‘Super App’ strategy.

The future

There is a looming reality that soon the rebundling of fintech products means that those with strong brands end up offering everything (e.g. personal finance management, crypto/stock trading, card issuing, savings accounts, savings goals, financial literacy, loans, BNPL etc), and then we create a highly siloed set of consumer experiences, which is mirroring exactly what Fintech’s ‘Unbundling’ phase was meant to mitigate. But for now, given the diverse nature of fintech offerings, this is a distant reality.

References

(1) https://en.wikipedia.org/wiki/Super-app

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.