Building financial wellness has big benefits for both customers and financial service providers in deepening relationships and sustainability. But learning how to wrangle our finances can seem complex, tedious and even overwhelming.

For banks, lenders and financial institutions, finding innovative ways to engage customers helps them stand out in a competitive landscape. For customers, being disengaged with their finances means they are missing out on big opportunities to grow their wealth, and for small banks & financial institutions, this poses a risk to relevancy & retention.

That’s where generating behavioural data within a game-based framework comes in. Moroku is leading the way in pioneering the next generation of online banking experiences. Founder Colin Weir believes that gamification and behavioural economics can revolutionise financial education and help people build better financial habits.

By recognising the need for play, our inherent love of challenges and incentives and rewards, Moroku is helping banks, wealth providers and fintechs to win by helping customers win.

What is Moroku?

The aim of Moroku is two-fold: gamifying the banking experience helps financial institutions deeply engage with their customers, while also empowering customers to foster better money habits to grow their wealth.

Moroku builds disruptive, digital banking experiences designed to inject fun into banking. The team’s cutting-edge behavioural banking engine uses AI and the power of game design to help financial service providers acquire, engage and retain customers.

With more competition in the financial services space than ever before, finding ways to stand out has never been more important. But according to Cap Gemini’s 2022 retail banking report, nearly half of the respondents feel their current banking relationships aren’t rewarding them (49%).

By tapping into the power of AI, Moroku is passionate about helping institutions deeply understand the needs of customers and deliver hyper-personalised, engaging user experiences.

Colin believes, “the future of banking is focused on the customer and helping them thrive with their money.”

Moroku, through their Odyssey platform, helps customers build financial fitness with personalised, game-inspired journeys that offer helpful nudges, tailored support and the ability to unlock content, money systems, rewards and awards that recognise and reward effort and loyalty.

The Moroku founder story

Moroku’s founder Colin has always had a passion for the power of data and AI.

Before founding Moroku, Colin used his background in forestry and data science to build models for predicting ecosystem growth. This experience sparked the idea of using data to understand customer growth in banking.

With a deep interest in what the next generation of banking looks like, Colin left Microsoft to set Moroku up as a “laboratory for figuring out where customers are on the journey, and how they’re growing. Thinking about how we understand that growth and how to build a data model around this growth.”

Who is Moroku for?

At the core of Moroku’s mission is the question: “How do we help banks win by helping their customers win?”

The platform has been developed with two core audiences in mind: the financial institutions that integrate Moroku into their operations, and the customers of these institutions who are interested in learning more about making their money work harder for them.

It’s the perfect solution for banks and fintechs who want to stay ahead of the competition by putting financial education and customer success at the centre of their decision-making.

“For us, we’re here to help banks and fintechs support, reward, and encourage customers as they start to build good money habits.”

Whether it’s first home buyers, budding investors, or helping Gen Z’s learn the basics of managing their money, Moroku’s AI gaming models reward customers for learning more about money and building good financial habits.

How does Moroku work?

Moroku’s flexible platform integrates with each service provider’s core banking system and user apps, helping to gamify the everyday experiences of mobile banking (from paying bills to hitting savings goals).

Its main purpose is to provide a unique and engaging customer experience by offering three key components:

- Player Maps – this feature provides knowledge of where a customer is on their player journey, from novice to master.

- Money Systems and Subsystems – these are money tools and capabilities that are unlocked by players as they master their money.

- Rewards and Awards – these are the ‘nudges’ that support the customers, incentivise engagement and let them know how they’re progressing on their journey.

Player Maps are inherent to games. As players level up they are presented with increasing levels of difficulty, missions and challenges (all link back to elements of money, from saving to investing). This keeps the game interesting and potentially endless while sparking meaningful behaviour change.

Banks have enormous numbers of tools and systems available for customers to take the guesswork out of money mastery. Yet knowing when and how to use all of these money systems is not obvious.

A good example of this is PayID in Australia. Being able to send money to someone’s mobile phone number or email address is a fabulous innovation. Yet less than half the country has set theirs up. Unlocking PayID as a spending weapon once you have passed level one makes this task fun, flipping it from a chore to an award to be won.

By sitting in the background of an institution’s existing architecture, Moroku’s engagement engine allows for a more authentic way to connect with the customer. It helps them build skills, overcome challenges and provides an enormous number of moments to engage customers and deepen the relationship.

It’s a win-win situation for both financial institutions and their customers.

Using games and data to build financial wellness

Why is it so hard to create (and sustain) good money habits? Colin points to two things: present bias and the need for immediate gratification, two key principles in behavioural economics.

“Part of behavioural economics is the idea of present bias. It’s this idea that we overly discount future gain. We’d rather have $1 now than have $2 tomorrow. We immediately feel a sense of loss,” Colin explains.

The science here is fascinating. Instead of focusing on long-term goals (which can feel abstract and even unattainable), Moroku helps customers celebrate small wins that get them closer to their end money goal. Colin goes on to explain how saving often feels like a loss, and why speaking to logic isn’t always the answer.

“We connect with people on an emotional level. As soon as the brain activity starts to move here, we move out of fight, flight or freeze and into solution mode. Money is very hard to use, and it’s full of emotion. So that’s where you have to go to get the results.”

By designing customer journeys around game principles, Moroku has found a way to make finance engaging, fun, and accessible for everyone.

Learning new skills (like building financial fitness or learning how to invest) can be a daunting task. But Moroku is breaking down these barriers with their gaming experiences, such as their virtual trading platform.

“Customers are provided with a safe place to try some things out, to understand the core principles in a virtual world where they could build these sorts of skills up. This is a space where they could fail, they could learn, and ultimately where they could overcome these challenges.”

Moroku uses individual missions, such as opening up a trading account or paying down a mortgage, which is tailored to a customer’s unique money goals.

With awards and incentives along the way, customers are rewarded for engaging with the platform and taking practical steps towards building financial literacy.

Improving Moroku’s customer journey using Open Banking

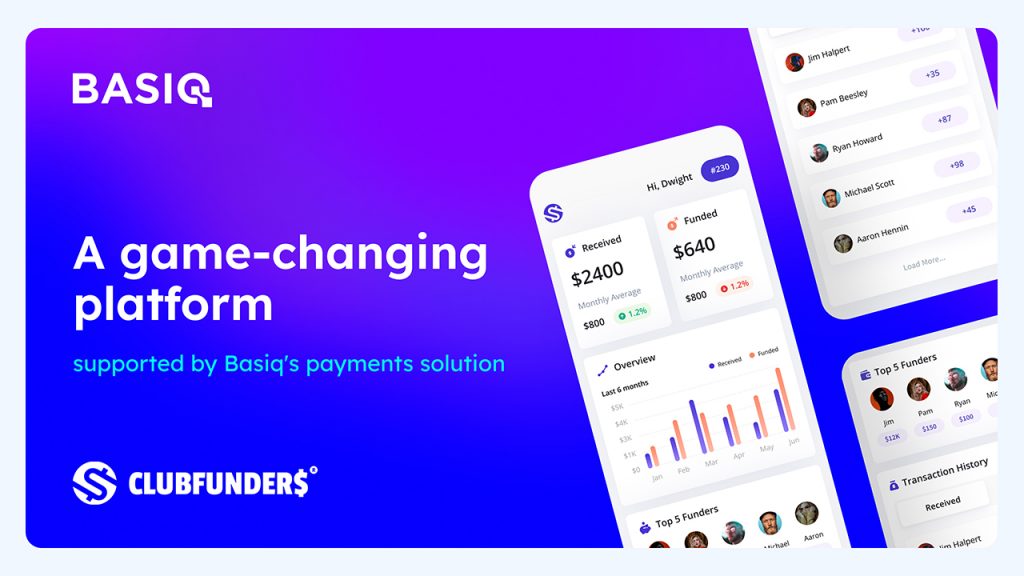

When it comes to Open Banking, Colin says that Basiq has helped Moroku get a deep dive into customer data.

“Once we transitioned to Open Banking, we got more data into the engine. That means we can take customers on a more accurate journey. Artificial Intelligence is incredibly data hungry. Whilst some generative models can quite literally generate their own data, gathering more behavioural data from customers’ broader financial relationships allows us to hyper-personalise journeys a lot faster.”

Using Open Banking, Moroku gains a comprehensive understanding of a customer’s financial history, habits, and situation, allowing them to build a personalised journey to help customers achieve their financial goals.

With 72% of customers expecting to receive a personalised banking experience, integrating this data into unique customer journeys has never been easier.

Colin says working with Basiq to integrate Open Banking data into the Odyssey platform has been a natural fit.

“The more data that we get, the easier those algorithms are to multiply to the point where we can have a hyper-personalised individual algorithm for every customer because we have access to the unique data to do that through Basiq’s Open Banking platform.”

What’s next for Moroku

Colin’s main focus is on rebuilding the banking experience in Australia with a mission-driven approach. He’s looking forward to making some big moves globally in the future, but at the forefront of his attention right now is getting Odyssey integrated into banks across Australia.

With the right support in place, Moroku is well-positioned to scale its offering, partner with more financial service providers across Australia and enable more Australians to build financial fitness and grow their wealth.

Find out more about Moroku and discover how it’s helping Aussie banks, wealth providers and fintechs win by helping their customers win.

Moroku is an integration partner accessing Open Banking via the Basiq platform. Interested in learning more about Open Banking through Basiq? Get in touch with our team.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.