Problem

The financial side of owning a property can be overwhelming for investors. If not managed well, it creates major headaches for their accountants, resulting in higher costs for the investor and unclaimed returns.

Siddharth Kawar from The Property Accountant needed a service provider to support his platform, streamlining accounting and financial management for investors and their accountants.

Solution

With the help of Open Banking via Basiq, investors can manage their entire portfolio via The Property Accountant dashboard in under five minutes a month.

Open Banking and Basiq’s Connect product enables customers to connect their bank accounts and use the information to automatically update, monitor and manage the income and expenses for each property. No more manual processes, DIY spreadsheets and boxes of receipts.

The Property Accountant is an accounting platform purpose-built for property investors. Whether investors own one or 20 investment properties, the platform makes it simple and easy to track income, expenses, market value, loan balances and even the net equity position of an entire portfolio in real-time.

Every property an investor owns comes with mountains of paperwork spread across different sources. From rental summaries to bank fees and depreciation schedules, collating this information has typically meant Excel spreadsheets, manual data entry and shoeboxes of receipts.

As an investor scales their portfolio, the time required to manage their increasingly complex asset also grows. It’s not hard to see why many investors consider managing their properties a second job, with lost paperwork and poor recordkeeping causing many to miss out on securing the best returns at tax time, too.

That’s where The Property Accountant comes in, offering a smarter way for investors to streamline the record-keeping and accounting of their investment portfolio.

Positioned as ‘Xero for property investors’, the platform collates all of a property’s accounting information in one place through live bank feeds and a unique email ID to share all records and documents. Not only can individual investors gain a real-time view of their portfolio’s position and generate income and expense reports in seconds, but data-sharing with tax accountants is as simple as giving access via an online portal.

Founder Siddharth Kawar experienced the challenges of managing a large property portfolio first-hand. After struggling to keep up with record keeping and missing vital information to maximise his tax refunds, Sid knew there had to be a better way for investors to manage their portfolios’ financials (and to simplify record-sharing with accountants, too).

From reactive record-keeping to real-time portfolio insights

Problem: Manual processes proving time-consuming and clunky

While business owners have had access to accounting software (like MYOB and Xero) for years, property investors have been forced to manually track their portfolio’s financial position.

Not only were spreadsheets tedious and time-consuming to update, but there has been no standardised approach to record keeping, making it difficult for accountants to deliver the best experience and results for their clients. These issues only compounded as investors expanded their portfolios, with no way to view the performance of their entire portfolio.

Initially, The Property Accountant platform asked users to upload bank statements and receipts manually. However, gathering these PDFs and files proved a big barrier to entry, increased the complexity of managing receipts and heightened the chance of missing potential tax deductions.

“In the beginning, I wasn’t aware of Open Banking or the Consumer Data Right. I was expecting users to upload bank statement PDFs and Excel spreadsheets to get the data, and quickly realised no one was going to do that.” – Siddharth Kawar, Founder & CEO of The Property Accountant.

As most investors aren’t accounting experts, the more complex aspects of their portfolio’s financials were left unchecked. For example, keeping track of interest charges and bank fees proved impossible in real-time when using manual record keeping.

Solution: Open Banking streamlines tedious admin

With crucial accounting information spread across multiple sources, The Property Accountant needed to automate recording keeping and streamline data-sharing between investors and their accountants.

After discovering Open Banking, Sid was able to replace spreadsheets and manual data entry with automatic bank feeds and real-time dashboards. By instantly capturing and integrating information from multiple sources (from loan amounts to rental property expenses), investors can easily track their portfolio’s performance and ensure they claim everything they’re entitled to at tax time.

“I want every client of mine to open the app in the morning and start their day by checking their portfolio’s net equity. That is my metric for success and financial independence.” – Siddharth Kawar, Founder & CEO of The Property Accountant.

From real-time updates on net equity to automatic recordings of interest and bank charges, investors gain complete visibility over their assets at all times, rather than waiting for tax time to roll around.

An accountant’s best friend

The Property Accountant isn’t designed to replace the need for an accountant. The opposite, in fact. The platform simplifies the working relationship between investors and accountants, ensuring accountants have all the information they need to deliver the best results for their clients.

“I’m simplifying the work for the accountant by offering a fully-fledged accountant portal on the platform.” – Siddharth Kawar, Founder & CEO of The Property Accountant.

After signing up and securing their own login ID, accountants are provided with access to their investor’s dashboard. Here, they can easily make changes to correctly categorise expenses and quickly assess the performance of an investor’s portfolio.

With basic data entry and record keeping taken care of, accountants can spend more time on strategic, value-adding work (such as providing expert advice to help improve their client’s tax position). This delivers a better outcome for investors and reduces accounting costs, too.

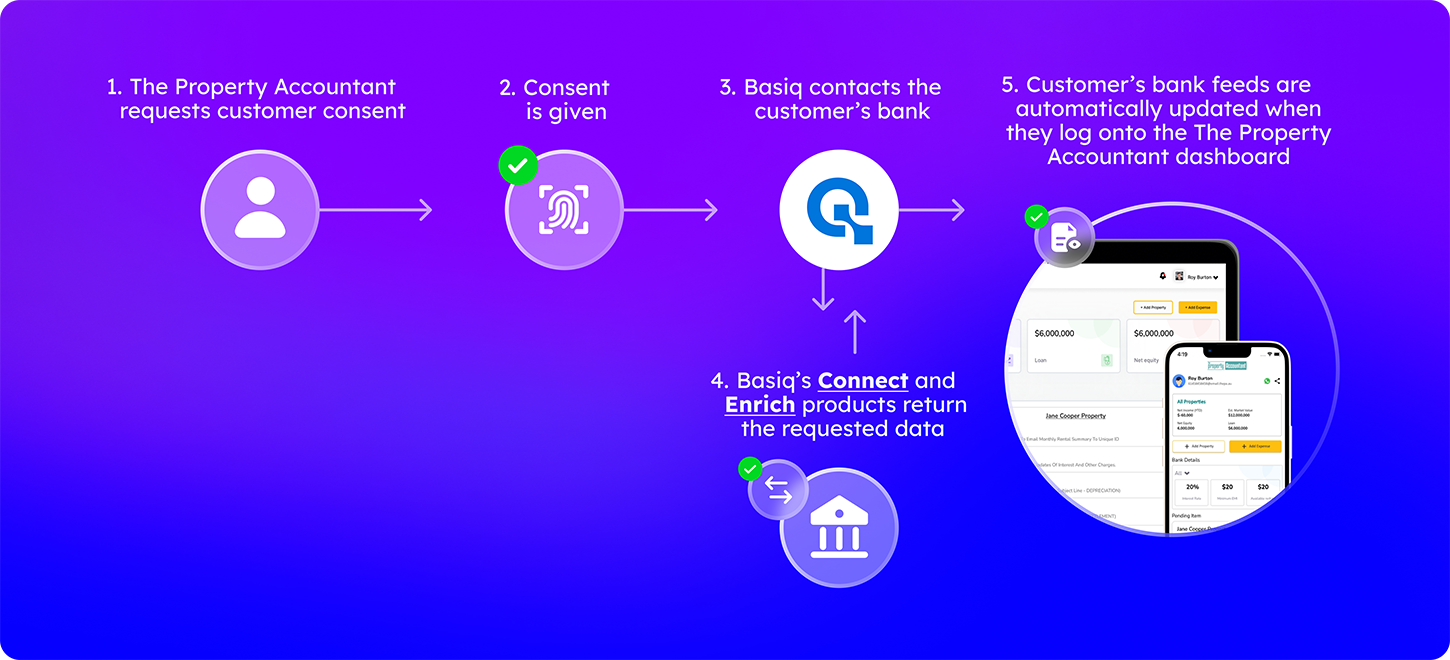

How The Property Accountant and Basiq work together

- The Property Accountant requests customer consent to access live bank feeds via Basiq’s Consent UI

- The customer accepts or declines permission

- If consent is given, Basiq contacts the customer’s bank

- The customer’s bank returns the requested bank data using Basiq’s Connect and Enrich products.

- All done, it’s as easy as that! Every time a customer logs on their live bank feeds are automatically connected, updating The Property Accountant dashboard with real-time information – until consent is withdrawn or expires.

Why The Property Accountant chose Basiq for Open Banking:

Top-notch onboarding

Finding a supportive onboarding team was crucial, as well as a provider who could offer flexibility and agility to support an early-stage start-up. Basiq’s local support team was able to meet those needs.

Additionally, in a rapidly changing sector, Sid wanted to partner with a provider at the forefront of legislative changes and innovation within Open Banking and CDR.

Value for money and seamless integration

Variable pricing model and ease of integration were crucial for Sid to ensure the platform could meet the needs of users both now and in the future. Sid said he was especially impressed with how easy integration with The Property Accountant platform has been using Basiq’s best-in-class developer documentation.

“My tech team loves the Basiq platform because the API integration is much simpler.”

Find out more

Find out more about The Property Accountant and how they’re making it easier to track the performance of your property portfolio as an investor.

The Property Accountant is accessing Open Banking via the Basiq platform under the Trusted Advisor model, supported by Basiq’s Connect and Enrich solutions.

Interested in learning more about Open Banking through Basiq? Get in touch with our team.