Understanding transactions to create better customer experiences

When it comes to transactions, you need to know where and how your customers are spending in order to communicate insights and nudge them into smarter financial decisions.

But the ‘transaction descriptor’ provided by banks doesn’t make spending easy to recognise or categorise. Transaction descriptors are made up of many parts with different information added by banks and merchants. By breaking this down we can see where the gaps are:

Basiq Enrich uncovers valuable insights

Basiq Enrich allows you to make encrypted and confusing transactions a thing of the past, with accurate and granular detail on the merchant, location and expense category of each transaction. This means you can uncover valuable insights such as changes in spending patterns or even identify opportunities to save based on discretionary versus non-discretionary spend.

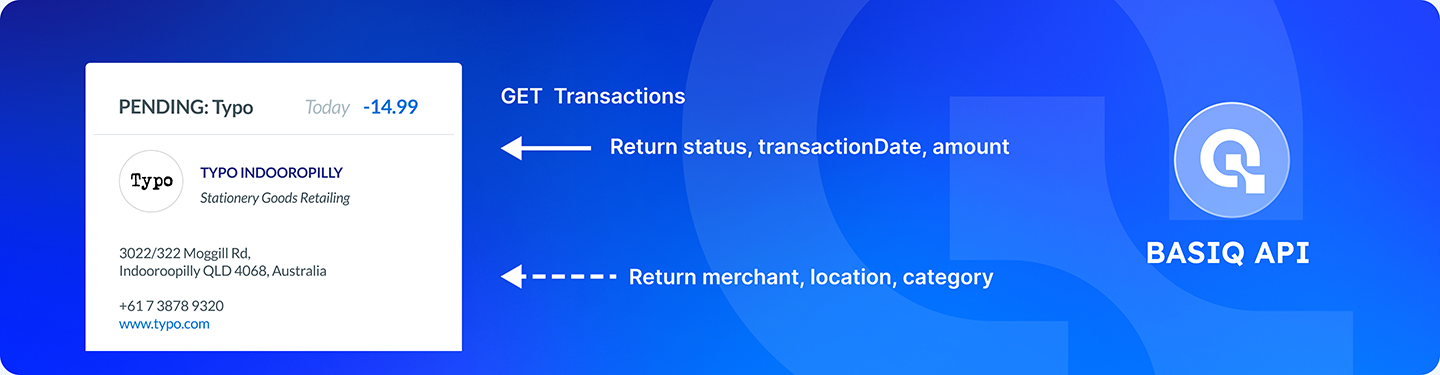

To help you accelerate new features based on spending insights, we’ve added the ability to return enriched transaction data via one endpoint. For the average app this will save valuable developer hours having to make roundtrip calls for enriched data across millions of transactions.

How it works:

Basiq Enrich users will now be able to retrieve enriched transaction data directly from the Transactions endpoint without an additional call to the Enrich endpoint. This means you can instantly see valuable metadata on each bank transaction to better understand customer spending and use this to accelerate new features to your app.

The below Transactions endpoint response for Basiq Enrich users shows granular detail on the merchant such as name and location as well as four levels of expense categorisation:

{

"type": "transaction",

"id": "2f93e7c4-b962-4639-b282-1c4916cd87a6",

"status": "posted",

"description": "CAFE ZO ZO NEUTRAL BAY AUS AUS Card xx4381 Value Date: 07/04/2021",

"amount": "-10.71",

"account": "2d565ee5-5095-4587-9b15-908bd34fd408",

"balance": "",

"direction": "debit",

"class": "payment",

"institution": "AU00000",

"connection": "3795f769-a4be-4a6c-b219-aa69beab93b1",

"transactionDate": "",

"postDate": "2021-04-09T00:00:00Z",

"subClass": {

"title": "Cafes, Restaurants and Takeaway Food Services",

"code": "451"

},

"enrich": {

"merchant": {

"businessName": "Cafe ZoZo",

"website": "",

"phoneNumber": {

"local": "0452 385 003",

"international": "+61 452 385 003"

}

},

"location": {

"routeNo": "139",

"route": "Military Rd",

"postalCode": "2089",

"suburb": "Neutral Bay",

"state": "NSW",

"country": "Australia",

"formattedAddress": "3/139 Military Rd, Neutral Bay NSW 2089",

"geometry": {

"lat": "-33.8313709",

"lng": "151.221332"

}

},

"category": {

"anzsic": {

"division": {

"code": "H",

"title": "Accommodation and Food Services"

},

"subdivision": {

"code": "45",

"title": "Food and Beverage Services"

},

"group": {

"code": "451",

"title": "Cafes, Restaurants and Takeaway Food Services"

},

"class": {

"code": "4511",

"title": "Cafes and Restaurants"

}

}

}

},

"links": {

"self": "https://au-api.basiq.io/users/ed512ba9-b558-4e70-ad13-f7f4b3a436ad/transactions/2f93e7c4-b962-4639-b282-1c4916cd87a6",

"account": "https://au-api.basiq.io/users/ed512ba9-b558-4e70-ad13-f7f4b3a436ad/accounts/2d565ee5-5095-4587-9b15-908bd34fd408",

"institution": "https://au-api.basiq.io/institutions/AU00000",

"connection": null

}

}The update also means newly enabled Basiq Enrich users can immediately gain access to enriched data and incorporate this into new products and features, whether it’s for smarter money management, spending notifications or helping nurture customers into affordability.

If you want to incorporate spending insights into your app with real-time enrichment, detailed classification, accurate merchant location and the latest merchant information, get in touch with the Basiq team.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.