What’s the go with Super?

Super is a $3.5t industry that has been largely ignored from a Financial technology perspective. Given the delicacy of Super, and the ensuing high barriers to entry, this is understandable – but Super and Financial Technology could work together to ensure that consumers are increasingly financially literate about their Super balances, ensure the fund aligns with their values and performs – while still protecting what is an incredibly valuable asset.

What’s the customer experience like?

Superannuation is a critical part of a person’s financial life. The moment you start your first job, it’s likely that you joined the Superannuation company that your employer offered. As you progress through your career, Super kind of just sits there, accrues, and is most commonly given as a ‘heads up’ during tax time. In addition, as a person gains new employment, more accounts may be opened, leading to an information silo between the funds’ balances, performance, and an increasing number of passwords to remember for all the different Superannuation portals they belong to.

What are the key problems associated with Super?

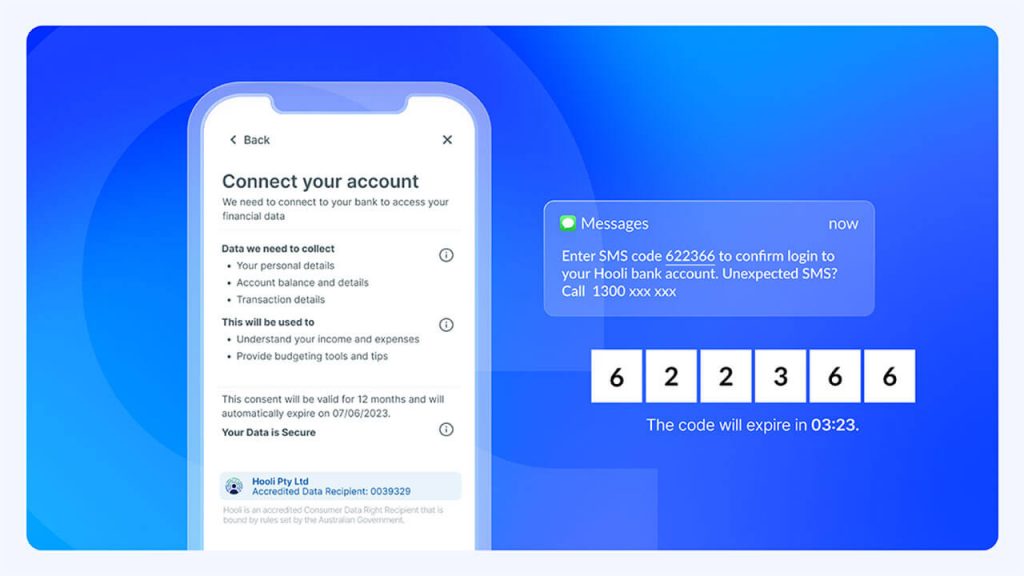

Fraud – The threat of scams underscores the critical need to authenticate recipients, ensuring that withdrawn funds are directed to the rightful individuals and mitigating the risk of fraudulent transactions.

Lack of visibility – Super funds do not provide information in an engaging, easily digestible way. A lot of lingo in Super is highly financial, especially when talking about portfolio weightings (equities, bonds, commodities) – which makes consumers put Super in the ‘too hard’ basket.

Information silos – if you have multiple superannuation accounts, not only does the issue of visibility get compounded, but it’s incredibly hard for a consumer to understand and track their (a) balance (b) where / how the money is invested and ( c) how the various funds have performed

Low engagement – few Super funds offer information in an easy-to-read and digestible format, such as a mobile-first app that can explain information about one’s superannuation account, or whether to shift toward a different portfolio.

Hard to switch and consolidate – Super can amount to a serious amount of money designated to retirement, which means there are low rates of switching (it’s scary moving that money), and it’s also difficult to consolidate multiple funds into one. This also leads to more fees for the customer.

What’s the benefit to a consumer if Super solves the problems above?

Peace of mind – knowledge that your financial assets within your superannuation fund are secure and that measures are in place to guarantee that any distributed funds go to the rightful owner.

Empathy – creating a product that can articulate a person’s current balance, combined with a forecast of their nest egg will show that

Financial literacy – consumers can better understand their financial position for their retirement, selecting a fund that aligns with their values while upskilling their understanding of where their money is being invested. They can also understand how to proactively adjust or weight their funds in the face of personal, micro or macroeconomic uncertainties.

Great user experience – a high rate of engagement with a Super fund leads to stickiness within a certain fund, and will ensure that the consumer doesn’t consider alternatives

Fee visibility and transparency – so consumers can stop paying fees for multiple accounts and have more for their future

Reduce ‘Super Shame’ – funds can tailor their campaigns to members about making contributions without considering their circumstances

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.