Basiq has always strived to make it easier than ever for Fintechs to create a native experience for your customers. Our integrated CDR compliant consent UI was the first step in providing Fintechs with an out of the box solution to manage the complex nature of capturing customers consent to access their financial data.

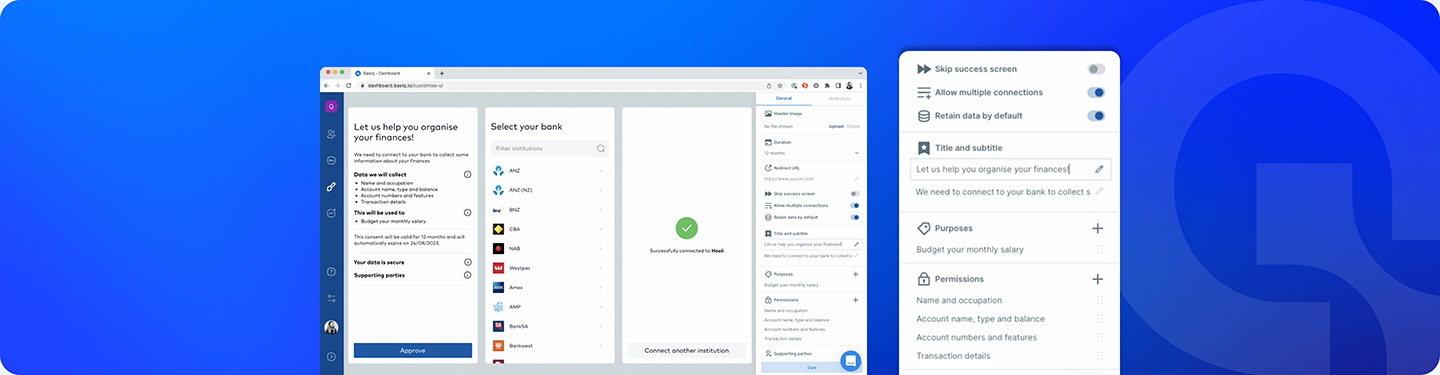

For all Fintechs enabled for Basiq 3.0, they have had the ability to customise this UI via the dashboard, and using the JSON editor to align with their applications branding. We saw a need to make this even easier so broader teams in the business can take the reins rather than having to rely on developer and engineering teams.

From today instead of updating the consent UI from the JSON editor, this can now all be configured via the Basiq dashboard with the added bonus of being able to view all of your changes via the live preview before publishing.

Customise and configure your UI in just a few clicks

Navigate to your dashboard editor to:

- Personalise text and messaging that greets your end users so it aligns with your brand’s tone of voice. All Consent policy fields can be configured including duration, policies, text and more.

- Take control of your user behaviour and flow: Looking to reduce the number of screens your user sees? Choose to skip the final “Successfully connected to…” page and instead redirect straight back to your own application.

- Configure institutions you want to show or hide to end users.

- Allow multiple institution connections to determine if your end user should be able to connect more than one institution at a time.

- Preview changes in real time in the Dashboard UI editor before publishing to your live application.

- Determine data management behaviour: Choose how you would like to handle your end users data after consent revocation.

A CDR compliant consent flow

We have combed through the 300+ pages of CDR customer experience guidelines so you don’t have to. Basiq’s out of the box consent UI solution removes countless hours of dev work for our Fintechs, with the ease of all being editable via the live preview on the dashboard.

Due to the complex nature of the CDR customer experience guidelines, we have identified and made it easy to know which areas you are able to edit so you can rest easy knowing your UI solution is always ticking the CDR compliant box.

Get customising – see it in action!

For more details check out our developer docs.

Watch this space – we have more updates on the way for our dashboard UI editor

- Go even deeper with customising your UI experience via the dashboard with the ability to update styling and CSS – no more JSON editor!

- Integrate 3rd party analytics tools directly from the dashboard – no need to paste those analytics codes into the backend.

Still have questions? Get in touch with the team at support@basiq.io

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.