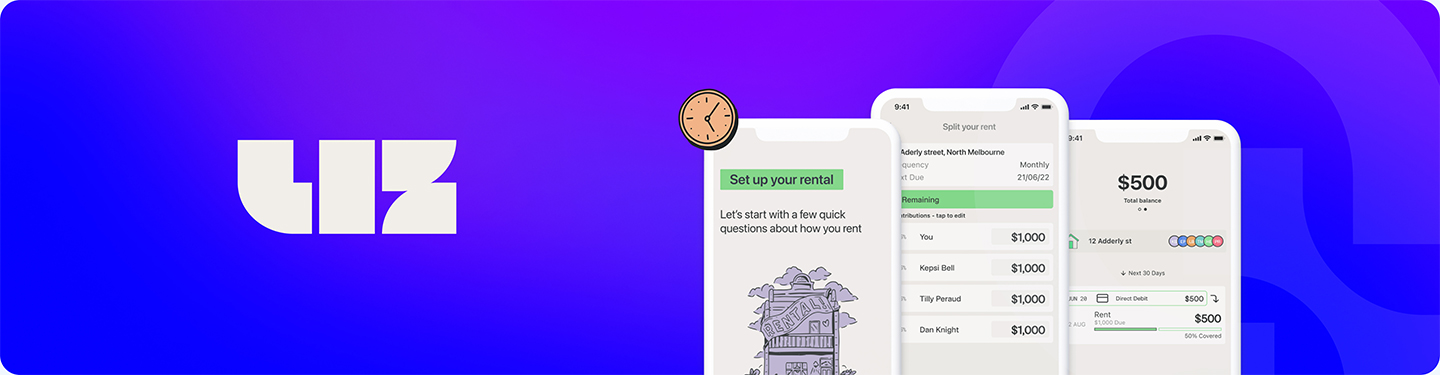

The team at LIZpay is on a mission to transform the payment of major recurring expenses, such as rent, through flexible, streamlined, and transparent payment processing. With increasing levels of financial anxiety disproportionately impacting young people and renters, LIZpay is putting people back in control of when and how they pay rent and other major recurring life expenses.

Creating smoother, transparent rental payments

LIZpay has partnered with Basiq to accelerate digital onboarding and gain a better understanding of their customers’ finances, such as spending habits, payday schedule and recurring expenses. Harnessing financial data, LIZpay helps tenants design a personalised deposit schedule to ensure that they have sufficient funds in their dedicated digital wallet by the time that their rent is due.

In a share house scenario, each tenant can sign up to the LIZpay app as separate users and set their respective portion of the shared rent, allowing each user to pay on a schedule that suits them. Rather than having one tenant keep track of the rent and shared expenses, LIZpay allows customers to create allocations within the app and ensures that payment is handled smoothly, whether directly to a landlord or an agent. Baxter Knight, Co-Founder at LIZpay, says:

“There is no doubt that the ability to leverage comprehensive consumer data such as pay cycles through Open Banking will play a really important role in allowing LIZpay to help tenants manage their rental payment and align these with a schedule that suits each individual consumer. As a result, we are really excited to have access to Basiq’s Open Banking platform.

Additionally, Basiq’s overlay services including income detection and spending analytics are what will allow us to provide users with instantaneous access to our transparent financial product offerings to help them smooth out their recurring payments, now and into the future.”

Curbing financial hardship in the rental market

Additionally, LIZpay is set to launch a buy-now-pay-later function to provide tenants with increased flexibility to manage their expenses by deferring payments such as bond, rent, and bills. For tenants, this will provide a helping hand when required, and in return, increase security for landlords and agents. Leveraging Basiq, LIZpay will be able to assess and predict hardship, speed up approvals and provide tenants with more personalised support and repayments.

Looking at the PropTech industry and rental market, Co-Founder Baxter Knight says:

“The industry is littered with companies that have a core focus on providing functionality for agents and landlords. We recognised a serious lack of offering for the largest engaged demographic in this space – the renter. Coming from renting backgrounds ourselves we understand the stress and anxiety that disproportionately affects renters, particularly when it comes to making what is their largest recurring life expense – paying rent – and this is what we want to change.”

The platform provides functionalities for every possible renter, including residential and commercial properties, as well functionalities tailored to people living in share-houses or dual occupant tenancies. Regardless of who manages the property, be it self-managed or agency-managed, LIZpay is compatible with all possible scenarios.

“Basiq’s support for startups and focus on innovative new technology made them the perfect partner to help grow our platform – we strongly believe them to be able to constantly evolve their offering to suit the changes in the market”

Baxter Knight, Co-Founder @ LIZpay

Find out more and sign up for early access by heading to LIZpay’s website and stay tuned for their app launch.

For more on how Basiq enables faster onboarding and an ongoing connection to data, head to the Basiq website.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.