The Consumer Data Right (CDR) in Australia has recently undergone significant updates, especially with the introduction of Business Consumer Disclosure Consent. This new form of consent broadens the horizon for business consumers, allowing them to share their CDR data with a wider array of service providers, beyond the traditional “Trusted Adviser” list. This list initially included professionals such as accountants and lawyers but now extends to include service providers like bookkeepers, finance brokers, insurance brokers, and business coaches.

If you want to know more about the changes have a read of our previous blog here.

So what’s the TLDR around business consumer consent?

Getting straight to the point, the new CDR updates include:

- Introduction of Business Consumer Disclosure Consent: Expands data sharing options for business consumers, facilitating sharing with a broader range of third party service providers.

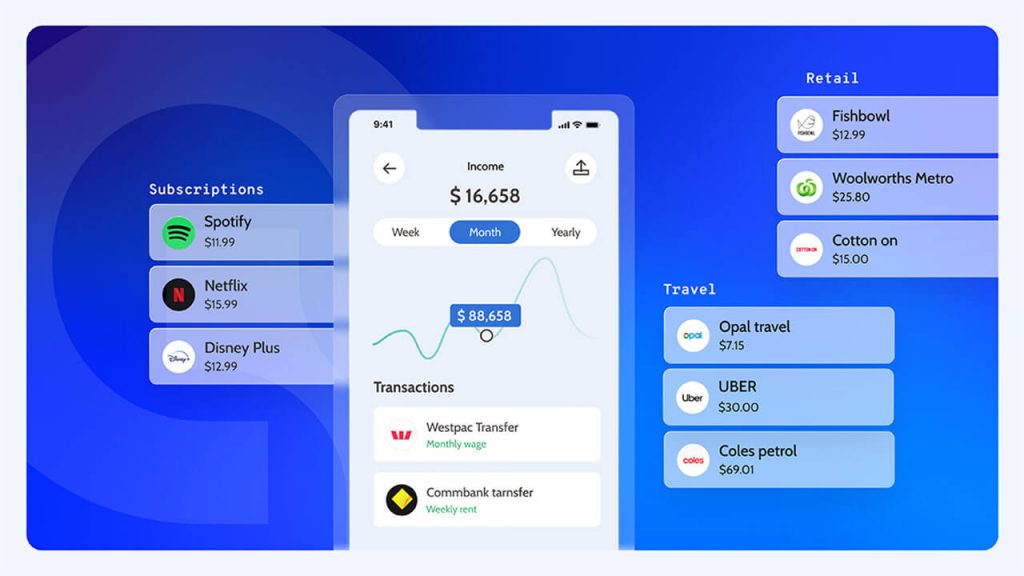

- Greater Flexibility with CDR Data: The V5 Rules update permits data sharing with software applications used for financial administration, offering substantial benefits for service providers and small businesses.

- Encouraging Open Banking Adoption: Tailored for “business consumers,” this update opens up new opportunities for sharing financial data, crucial for accessing various funding options.

So what are the benefits for service providers?

- Expanding Data Sharing Capabilities with less legal requirements: Service providers are able to access valuable CDR data and use it based on their existing business agreements without being bound by CDR rules.

- Streamlining Financial Operations: With access to a broader range of applications for financial administration, businesses can streamline operations such as payroll, invoicing, and more.

- Facilitating Access to Funding: The ability to share bank statements with finance brokers more efficiently opens up a plethora of funding options for businesses.

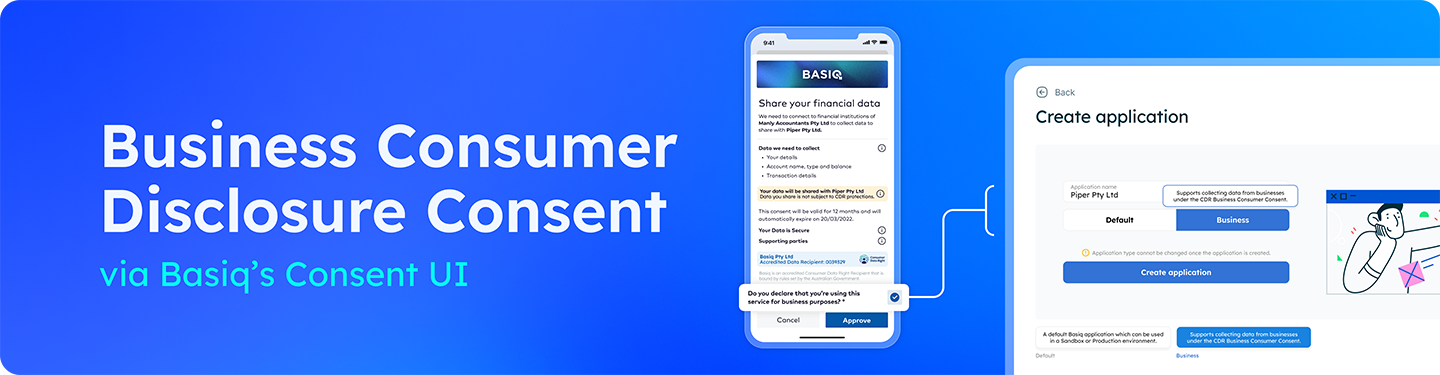

Business Consumer Disclosure Consent via Basiq’s consent UI

The recent updates to the CDR, present a new opportunity for businesses to engage in data sharing. Basiq’s consent UI has been enhanced to accommodate these changes, ensuring that businesses can leverage our platform to share financial data with a broader array of service providers. This enhancement is integrated into our existing consent UI, ensuring that the user experience remains consistent and intuitive.

So let’s take a closer look 🔎

The service provider Piper is wanting to collect business account details from a customer so they can offer a better service for their customer. They have integrated with Basiq to use their consent UI solution to allow their business customers to securely connect and share their bank account details in order to speed up this process and reduce manual processing.

- The customer is met with a pre-consent screen within the piper application.

- When they agree to continue they are taken to Basiq’s consent UI flow to facilitate the secure access to account details through a relevant financial institution.

- The user is presented with details on; who has requested them to share the data (piper) and who is securely collecting it on Piper’s behalf (the ADR – Basiq), what details are being collected, for what purpose and for how long this consent will be valid for.

The Basiq consent UI simplifies the complex and verbose consent flow established by the ACCC and DSB CX (Customer Experience) guidelines. Our focus has always been to strike the perfect balance between compliance with the Consumer Data Right (CDR) regulations and offering an intuitive, user-friendly experience that maximises conversion rates. It aims to:

- Reduce Drop-offs: By simplifying the consent flow, we aim to decrease the likelihood of users abandoning the process.

- Increase Transparency: Users are well-informed about the specifics of the data sharing agreement, fostering trust and confidence in the process.

- Maximise Engagement: A streamlined and user-friendly consent process encourages higher engagement rates, benefiting all parties involved.

The updates to Australia’s Consumer Data Right (CDR), featuring Business Consumer Disclosure Consent, significantly broaden the scope for financial data sharing, enhancing operational efficiency and financial management for businesses. The integration of these updates into the Basiq consent UI simplifies the data consent process, ensuring compliance while optimising user engagement. It enables service providers to offer more tailored solutions, streamlining operations and reinforcing trust in data sharing.

As open banking evolves, Basiq continues to innovate, empowering clients and their customers to maximise the value of their financial data.

Interested in leveraging business consent to better your service offering?

Get in touch with the team today for a friendly chat and to learn more.

Resources

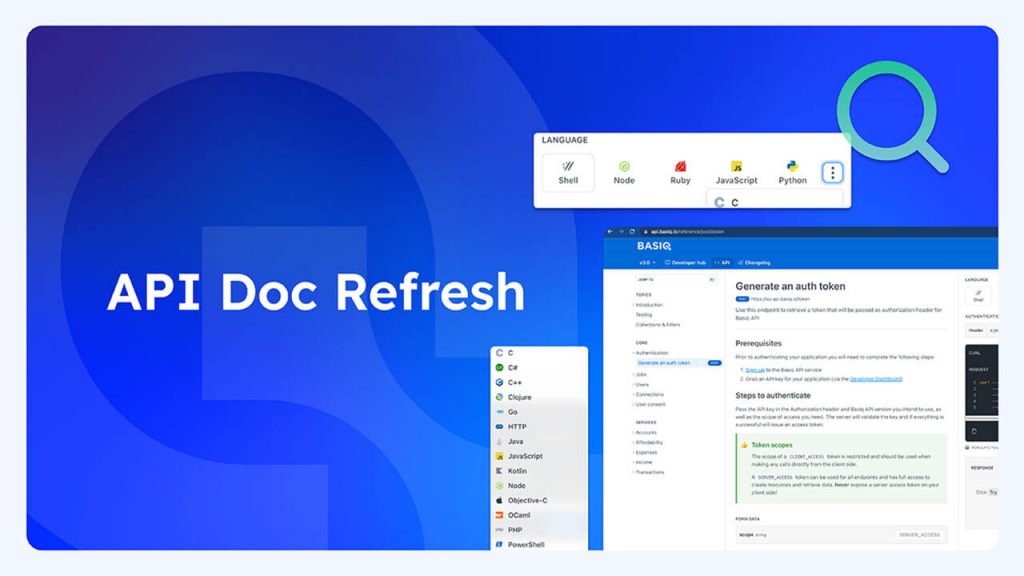

Have a read of our developer documentation to understand how you can get started with BCDC.