We’re constantly improving Basiq Enrich so you can understand customer spending and deliver better financial solutions. Recently, we retrained our expense categorisation model with +3M training records to expand coverage and increase accuracy to +90% so you can get accurate spending insights across more Australian and New Zealand merchants.

The prep work

Being able to accurately classify and categorise payment transactions is the first step to understanding customer spending and delivering better financial solutions. But transaction data is often messy, lacking information and not standardised.

Because data isn’t standardised, each institution presents a new set of challenges, with every institution describing transactions in a unique way.

As an example, a purchase from Tony Bianco could look completely different across the Big 4:

| Bank | Transaction Descriptor |

| NAB | V6092 29/05 SP * TONY BIANCO COLLINGWOO 74617630150 |

| WESTPAC | SP * TONY BIANCO COLLINGWOOD VIC |

| ING | SP * TONY BIANCO – Visa Purchase – Receipt 125282In COLLINGWOOD Date 29 Dec 2019 Card 462263xxxxxx4392 |

| CBA | SP * TONY BIANCO COLLINGWOOD VI AUS Card xx4832 Value Date: 16/10/2020 |

A unique strength of Basiq’s categorisation engine is that we can standardise and aggregate transaction data from +100 institutions across Australia and New Zealand before before sending it for categorisation. Each transaction is classified based on whether it’s a debit or credit:

| Debit |

|---|

|

| Credit |

|---|

|

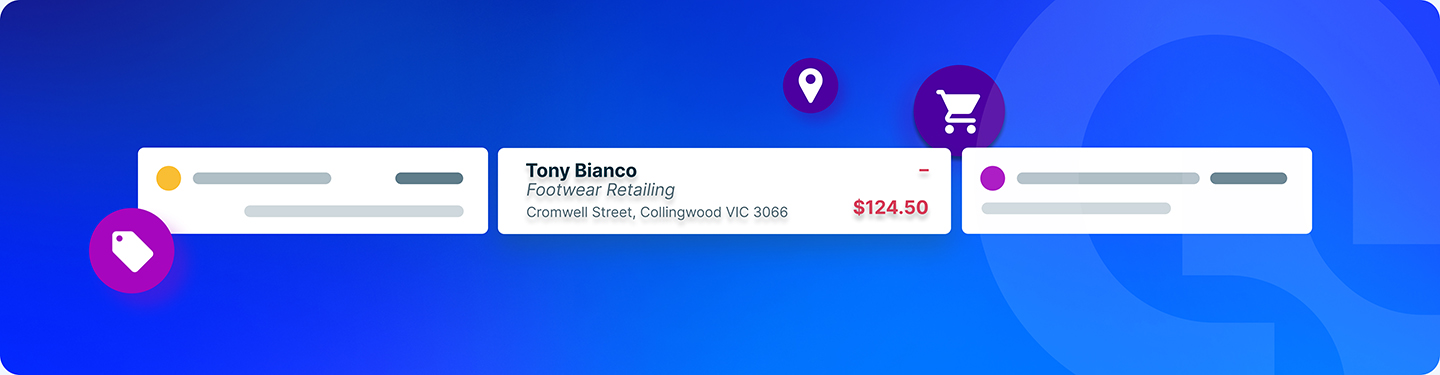

Once a payment is identified, Basiq Enrich cleans and enriches transactions to reveal the true nature of spend:

Expense categorisation with +90% coverage and accuracy

An important part of our enrichment process is the ability to enhance Payments with multiple attributes such as merchant details and expense category.

Recently, we processed +3M transactions to retrain our expense categorisation model for the below results:

- Coverage: +90% of of Australian and New Zealand merchants recognised

- Accuracy: +90% of merchants correctly categorised

For every transaction categorised, we provide detailed industry classification at 4 levels, so that you can pan out and zoom in as necessary. For example, if a customer shops at Tony Bianco, “Retail trade,” only tells you part of the story, but to understand what your customers are really spending their money on, you may need more granular detail such as “Footwear retailing” ⬇️

"category": {

"anzsic": {

"division": {

"code": "G",

"title": "Retail Trade"

},

"subdivision": {

"code": "42",

"title": "Other Store-Based Retailing"

},

"group": {

"code": "425",

"title": "Clothing, Footwear and Personal Accessory Retailing"

},

"class": {

"code": "4252",

"title": "Footwear Retailing"

}

}

} By retraining our model we have also reduced false positives so that we can make improvements to our expense categorisation more quickly and frequently to incorporate the latest merchant information and industry changes.

If you want to incorporate spending insights into your product, get in touch with our team to see how Basiq can help.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.