Increase in online fraud

One of the consequences of COVID-19 was the rapid digitisation of financial services and with that, unfortunately, came an increase in online fraud. Australian consumers and businesses lost more than $2 billion to scams in 2021, more than double the $851 million reported lost in 2020.

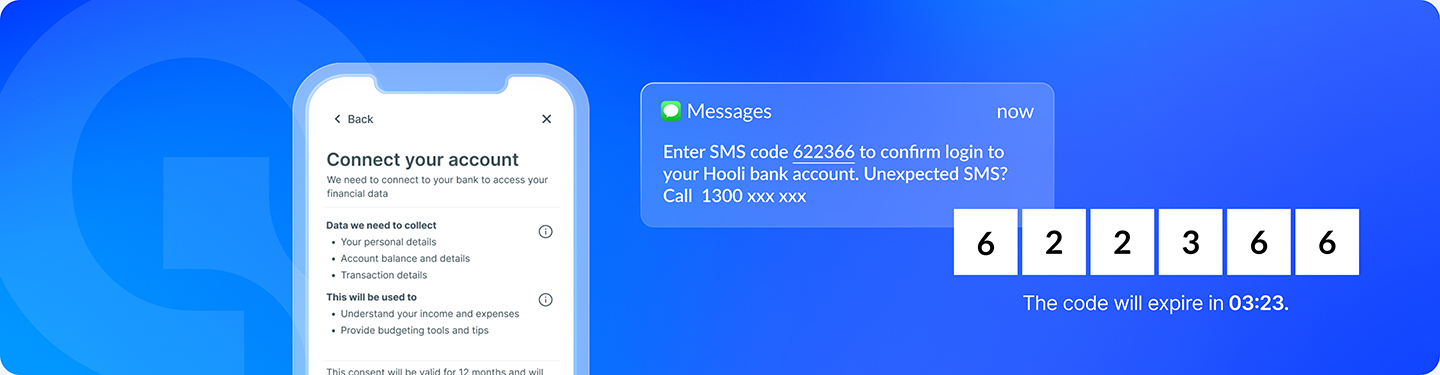

This has forced banks and financial institutions to up their security game, especially when it comes to the protection of consumers’ hard-earned funds. To combat fraudsters, banks have resorted to implementing advanced security measures such as multi-factor authentication when customers log on that can differentiate between a bot and a human, setting in motion the gradual decline of web connector services.

We are already aware of three major banks actively implementing measures preventing access to web-connected data, and other banks have already communicated that the changes are imminent.

More security conscious consumers

Additionally, recent major data breaches have made consumers more vigilant than ever when it comes to data sharing, further increasing the risk to banking data access. Almost one-third of Australians report they have been exposed to a data breach in the previous 12 months.

To date, the industry has been able to develop workaround solutions but as banks’ security measures become more sophisticated, fixes are becoming more difficult and not guaranteed.

Web connectors will be banned

We know web connectors to access banking data are on their way out. This view was supported in the final paper from the Statutory Review of the CDR that recommended banning web connectors in the near future where the CDR is a viable alternative. For banking, a viable alternative is already available; Open Banking.

Data quality has always been one of the biggest challenges deterring businesses from making the switch. In response, we have been monitoring and testing the quality of data over an extended period of time. As the Open Banking traffic flow has increased, we have seen the quality improve and is at a point where it is performing as it should.

While there are still improvements to be made, all stakeholders involved from banks and financial institutions to the ACCC, are working hard to address these as soon as possible and Basiq is actively contributing to this process.

Want to find out more?

To learn about how the Open Banking ecosystem is growing, including the changes impacting data access and how your business can make the switch, visit the Open Banking campaign page.

You can also find a number of educational and practical resources we have pulled together to help demystify and provide guidance on how to access CDR data.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.