Australia is experiencing a significant transformation with the potential to impact not only the financial services sector but also any industry the Government decides to designate under the Consumer Data Right (CDR). This change is brought about by Action Initiation, a groundbreaking legislation that has passed the lower house and is currently under review by a senate committee, with a report anticipated in early May 2023.

What is Action Initiation?

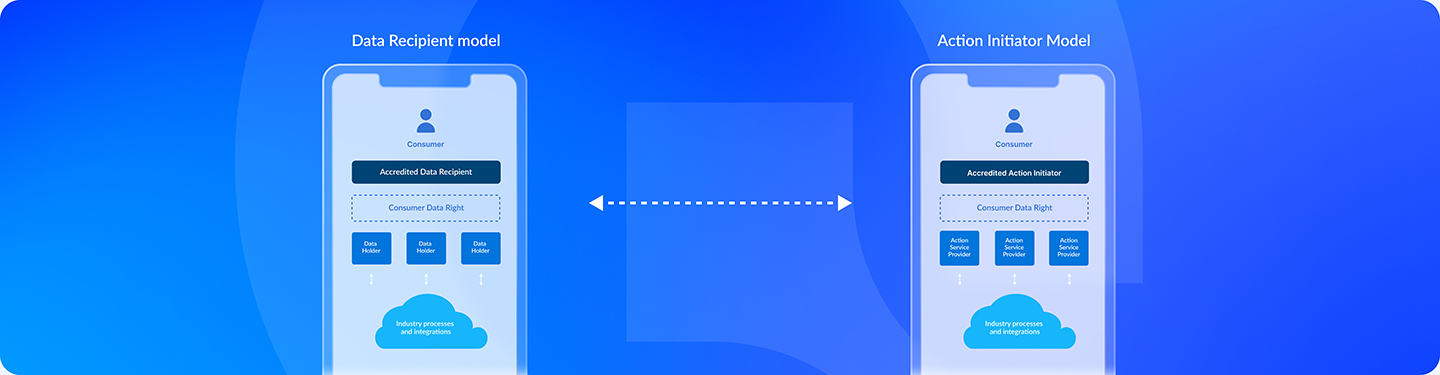

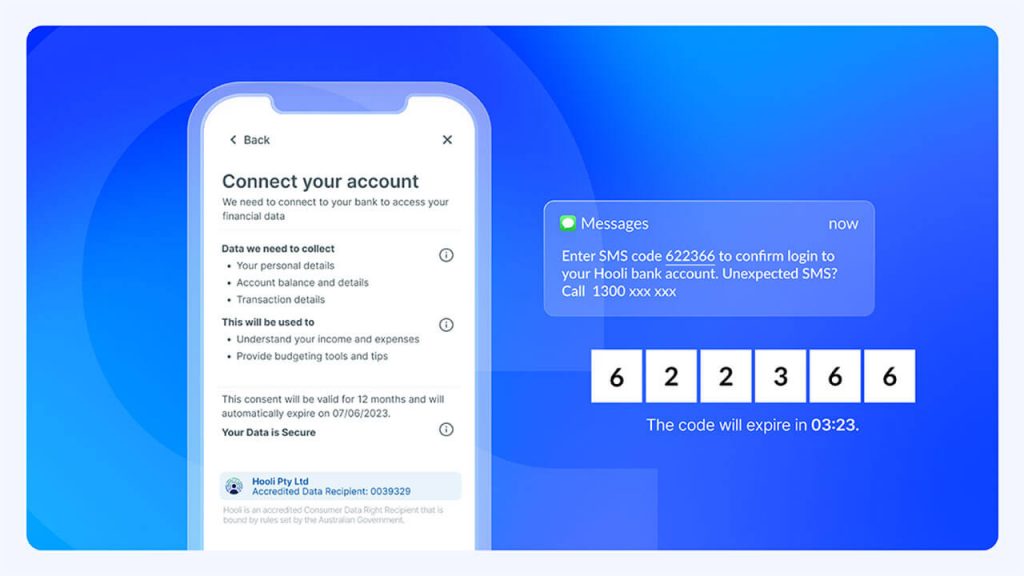

Action Initiation is designed to enhance the success of the CDR program and spur innovation in the Australian economy. Unlike the existing CDR, which only allows read-only API services for accessing data like banking and energy information, Action Initiation will extend these capabilities to include write services, enabling modification of data and services through an API interface.

The Government will have the authority to designate any actions it deems necessary, and all industries that are designated by CDR will be required to comply. For example, if the government decides account management is essential, industries within the CDR framework (banking, energy, telecommunications, and more) will need to implement typical CRUD-based account API services, allowing users to open, close, update, and read account details.

The primary goal of Action Initiation is to increase competition in the industry, for example, making it easier for consumers to switch accounts. For instance, if a consumer finds a better interest rate from another bank, they could grant that bank access to their existing account, allowing the new bank to transfer all data, open a new account, and close the old one.

However, there is a potential downside to this legislation. Instead of fostering a competitive environment, it could inadvertently reduce the number of service providers, limit consumer choice, and pave the way for a “super app” that dominates the market.

Potential risks of Action Initiation

It is crucial to consider these possible negative impacts and the implications they may have on the industry and consumers:

Loss of brand identity and loyalty

With the implementation of Action Initiation, consumers may no longer interact directly with service providers through their websites or apps. Instead, they would use third-party apps that access and manage their accounts, effectively turning every consumer-facing organisation into a white-label service. This could lead to a loss of brand identity and loyalty, as consumers might focus on the third-party app rather than the underlying service provider.

Disproportionate advantage for third-party apps

New third-party apps would have a significant advantage over smaller banks, energy retailers, and telecom companies, as they would not be bound by the same regulations as the underlying service providers. This could result in an uneven playing field, with third-party apps enjoying more freedom and flexibility in their operations, while traditional service providers struggle to keep up.

Market consolidation and reduced competition

As third-party apps gain power and influence in the market, smaller service providers may struggle to compete and attract customers. This could lead to market consolidation, with only a few dominant third-party apps controlling consumer access to various services. The decrease in competition could, in turn, limit consumer choice and stifle innovation.

Barriers to entry for new service providers

With the increasing dominance of a few super apps, new service providers might find it difficult to enter the market. They would need to convince these super apps to support their services, which could be an uphill battle due to the growing power and influence of these apps. This situation could create barriers to entry, discouraging new players from entering the market and further reducing competition.

Dependence on super apps and potential monopolies

If the market evolves to a point where consumers rely solely on a few super apps for their banking, energy, and telecommunications needs, these apps could gain significant control over the industry. This concentration of power could lead to monopolistic practices, such as price fixing or collusion, ultimately harming consumers through reduced choice and higher prices.

Regulatory challenges

The increasing dominance of super apps could pose new regulatory challenges, as governments might struggle to maintain fair competition and protect consumer interests in a market dominated by a few powerful players. Regulators may need to adapt their strategies and develop new tools to ensure that the original goals of Action Initiation are achieved without sacrificing consumer choice and market competition.

Striking a balance when it comes to Action Initiation

While the UK Open Banking model has seen success, it is essential to recognise that the Australian framework is fundamentally different. The UK model is banking-specific and limited to payments, whereas the Australian CDR program extends across multiple industries with ambitions beyond executing payments.

To address the potential pitfalls of Action Initiation, it is crucial to carefully consider the implementation process. Here are some recommendations to ensure the legislation’s success while avoiding the risks outlined earlier:

Encourage industry participation in defining actions

The government should create the framework and accreditation layer for Action Initiation but avoid dictating the specific actions to be implemented. Instead, individual organisations that provide the services should be allowed to decide their participation and define the services and API specifications that best suit their needs and strategies. This approach ensures that the rules of competition remain the same, giving service providers the choice of whether they want to implement action services and how they should look like.

Foster innovation and tailored services

By giving organisations the freedom to define their actions within the Action Initiation framework, businesses can focus on delivering value to their end consumers through tailored services that distinguish them from competitors. This approach promotes innovation and avoids turning the entire industry into white-label service providers.

Establish a robust accreditation framework

The government should focus on developing a strong accreditation framework that ensures participating organisations have been thoroughly vetted and have the appropriate security controls in place. This approach protects consumers and maintains trust in the system without hindering the innovation and differentiation that organisations can provide.

By empowering businesses with greater choice, they can determine how to use Action Initiation to compete and differentiate their offerings in the market. With a thoughtful approach, the legislation can drive innovation and empower consumers, shaping a better future for Australia’s industries.

In conclusion, while Action Initiation has the potential to revolutionise the Australian economy, it also poses significant risks in terms of market consolidation, reduced competition, and increased reliance on a few dominant super apps. It is crucial to carefully consider these potential downsides and their implications on both the industry and consumers. As Aesop’s Fables warns, “Be careful what you wish for, lest it come true!” (260 BC).

Interested in learning more about Open Banking and Action Initiation? Check out our Open Banking Hub!

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.