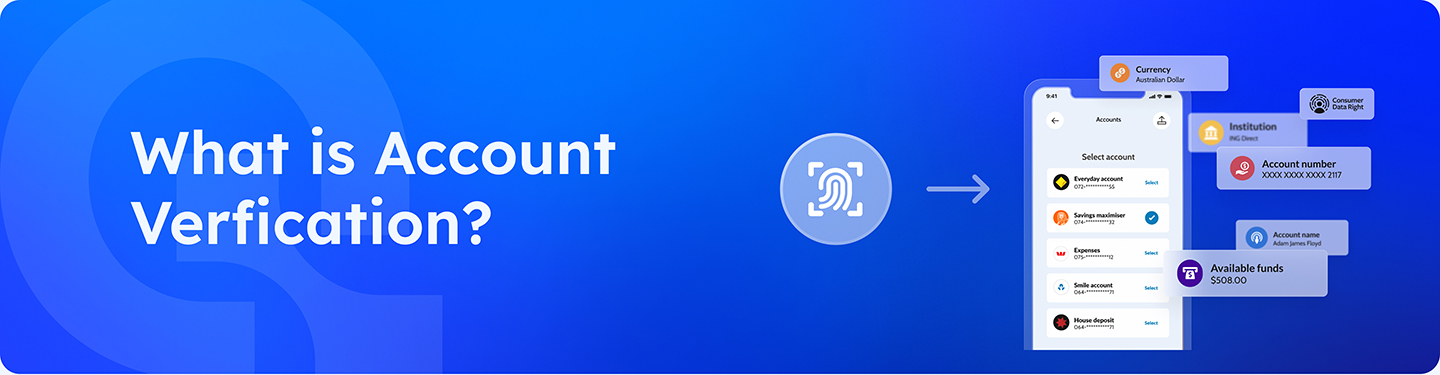

What is Account Verification?

By taking advantage of innovative technology and creative ideas, Basiq has implemented a new account verification process. Quick, efficient, and practical, our account verification provides a seamless onboarding experience for customers and merchants.

With our real-time access to data, both merchants and consumers will be in a better place to manage their finances.

- Reduce application abandonment through streamlined customer onboarding and a faster, more effective account verification process.

- Consumers no longer have to worry about remembering each banking password to take control of their money.

- Cut out time-consuming, cumbersome merchant processes with real-time access to financial data.

- Innovative advances with partner companies create groundbreaking financial technologies that improve customer and merchant experiences.

Account verification benefits for individuals

Slow, inefficient, and inaccurate identity verification for account holders is frustrating and can have significant consequences. Meticulous account verification is crucial whether you’re hoping to transfer $50 or receive your inheritance. A single digit in the wrong place could mean missing out on thousands.

Yet, users don’t just want accurate bank account verification. Individuals wish for instant verification. Australian banking currently relies on obsolete systems that result in delays and errors. Who has time to send physical copies of bank statements in for verification that could take four days in today’s world?

There are no excuses for such cumbersome systems with the availability of modern technology. Open Banking and financial technology protect users from mistakes, fraud, and time-consuming processes.

Customer use case

The use case for individuals: LIZpay is an app that aims to smooth the process of recurring payments, such as rent. Basiq’s account verification allows users to access banking data in real-time and put renters back in control of their financial situation.

Problem: Say you live in a house-share with three other tenants. Instead of the traditional system of each tenant putting your rent into a deposit account managed by one tenant, LIZpay allows you to pay your rental expenses when it suits you.

Solution: LIZpay ensures landlords receive the money on time by giving them access to their customer’s financial data (including payday, spending habits, and recurring expenses).

Customer benefit: Basiq’s efficient and effective banking solutions and LIZpay’s innovative ideas help tenants manage their money better.

Read more: Curbing financial hardship in the rental market with LIZpay

Account verification benefits for merchants

Verifying account holders is imperative for protecting consumer data and the business’s reputation. As the world becomes more digitalised, consumers expect fast, efficient, and immediate results. If you require your customers to follow a long-winded verification process, the chances are they won’t stick around.

Your market potential could rocket with an easy-to-integrate application programming interface (API). Instead of excluding customers, you can expand your outreach with an accessible and straightforward to navigate banking platform. The gap in the market, between the tech-savvy young and the loyal older generations, is yours to capture.

Plus, you can mitigate risk with quick, reliable, and secure account verification. Fraud on any scale can do significant harm. Not just damaging your business finance, but devastating your reputation, fraudulent banking and financial matters are ruinous. Dependable and effective, Open Banking account verification guarantees everyone’s safety.

Customer use case

The use case for merchants: Archa is a corporate card and expense management platform reinventing business banking. Basiq helps power Archa’s onboarding process with real-time account verification.

Problem: Setting up a business bank account involves a lot of manual processes that rely on paperwork and in-person branch visits. Coupled with lengthy issuance times, access to business banking and ongoing admin often become a barrier to growth.

Solution: Basiq helps power Archa’s onboarding process with real-time access to account and transaction data which means Archa can verify accounts and bring customers on board in a few clicks.

Merchants benefit: By re-bundling expense management with corporate card issuing, Archa can significantly reduce costs and complexity so businesses can invest more in their growth

Read more: Reinventing business banking with Archa

Account verification benefits with Open Banking

The current hurdles a bank customer has to jump over to move their account information from one financial product to another are ungainly and inconvenient. However, with the innovations of Open Banking and the capabilities of emerging technologies, data sharing and account verification will become seamless.

With Basiq’s Connect, take advantage of Open Banking account verification capabilities to onboard customers smoothly and trouble-free. Your customers will be ready for their first payment straight away within a few clicks and confirmation of their details (e.g. BSB, account number, title, and primary income account).

Account verification is one of the most popular use cases for Open Banking as it enables customers to change BSB/Acc no for BNPL disbursements without a manual process. Interestingly, pre-Basiq, Afterpay used a PDF doc to change details.

Connect removes the need for a back and forth between the bank and the consumer. Payers and collectors can enjoy a unified, simple repayment experience with immediate identification and verification.

In addition, Connect reduces the risk of fraud and assists with KYC/AML. Not only do companies confirm with AML and KYC regulations by using account verification, but they can also take the inputs from the Basiq transaction data and ingest them into their risk engine. For example, if a merchant has several chargebacks, it’s suspicious and can feed into a risk engine.

Basiq provides the data for merchants with a risk engine that defines their risk appetite to either enrich or provide additional insights. Rest assured that Basiq protects both customers and businesses from deception and deceit.

Customer use case

The use case for merchants: The Regional Australia Bank offers loans, mortgages, and other financial services.

Problem: Recently, the Regional Australia Bank partnered with Basiq to improve their verification processes and ensure that their customers can trust they are banking secure and safely.

Solution: Basiq’s sandbox environment is a solution to helping established companies trial fintech without running into financial difficulty or risk. With Basiq’s affordability report technology, lenders can streamline their processes. Regional Australia Bank’s lending specialist can now negotiate new loans based on customers’ real-time financial data.

Merchants benefit: Enables a faster, more efficient mortgage application journey for customers buying a new house. As a business, Regional Australia Bank can maintain their customer’s satisfaction and ensure they lend money reliably — based on verification from actual bank amounts.

Read more: Regional Australia Bank solves the Responsible Lending problem

Instantly verify account ownership and balances in real-time

Basiq helps businesses improve their customer experiences. With an easy-to-use banking API, individuals or organisations can trust that access to your financial data is easy and secure. Our real-time insights into data help you provide the right financial advice to your consumers.

Our instant verification processes ensure that data recipients and information sharing are consented to by the customer. With a two-step verification process that requires the customer to log in to their bank account, you can trust that everyone is protected.

However, we don’t just look after the banking industry. Other sectors also use our technology, including lending, collections, and debt recovery, PropTech, wealth and investment, crypto, and landlords to instantly verify rental tenants.

Plus, our unified API can grow with you. Our API can handle multiple data sources and use cases as your business scales. With innovative approaches permeating many industries, Basiq is ready to help you create better relationships with your customers.

Customer use case

The use case for merchants: Basiq partnered with Zepto Payments to enable merchants to avoid dishonour fees and deliver a frictionless experience to customers. Zepto can verify account information before making direct debit transactions.

Problem: Australian merchants waste approximately $432 million in dishonour fees a year. That doesn’t even account for administration costs dealing with failed payments and involuntary churn due to dishonours.

Solution: Zepto uses the Basiq Open Banking Platform to enable customers to securely connect their bank accounts to simplify bank transfers and create a seamless payment experience. With fast, adequate, secure account verification, Zepto can streamline its services and improve customer experience, eliminating error ensuring the majority of direct debit transactions are successful.

Merchants benefit: Basiq enables Zepto to have 99.8% confidence that all direct debits will be successful. The merchant can preemptively communicate with the customer before a payment fails if they don’t have sufficient funds.

Read more: How Zepto is revolutionising the payments industry?

Additional customer use cases

Cape: Saving time and improving the customer experience

The use case for merchants: Cape empowers startup businesses to take control of their digital banking. With a focus on helping companies get started, Cape believes that everyone should access tools and improve their loans and finances.

Problem: Setting up business accounts and banking in Australia can be a long-winded, time-consuming process. Customers do not have time to send their proof of identity to a branch and wait four days for a response. Likewise, small to medium enterprises lack the time, money, and resources to follow cumbersome account verification processes that most of the banking sector offers.

Solution: The Basiq launchpad for startups is a dedicated approach to help young companies utilise fintech to get into the market faster. Cape utilises Basiq’s technology to ensure startups have access to a banking product that allows them to take control of their finances. Cape helps innovators scale with access to real-time data as part of our launchpad.

Merchants benefit: Cape and Basiq’s partnership helps startups streamline their finances using Basiq’s instant secure account verification.

Read more: Cape and Basiq join forces to speed up SME loan access through Open Banking

Fupay: From data aggregation to data-driven automation

The use case for merchants: Basiq partnered with Fupay to offer Fuflow, a predictive money management tool that +140,000 users of the Fupay app love.

Problem: By combining a customer’s live financial data into one view, traditional money management apps help inform customers of their financial position. Most money management tools provide a retrospective view of a customer’s money, which means that customers are left a step behind when it comes to managing their finances.

Solution: The Fuflow solution leverages the unique combination of Basiq’s Open Banking platform and Fupay’s unique machine learning algorithms to predict future income accurately, bills, and spending with 95% accuracy.

Merchants benefit: By leveraging Basiq, Fupay can forecast net cash flow across future pay cycles. It shows users where they are heading and the future impact of their spending and savings decisions.

Read more: Delivering the next generation of money management with Fuflow

Innovate with Basiq

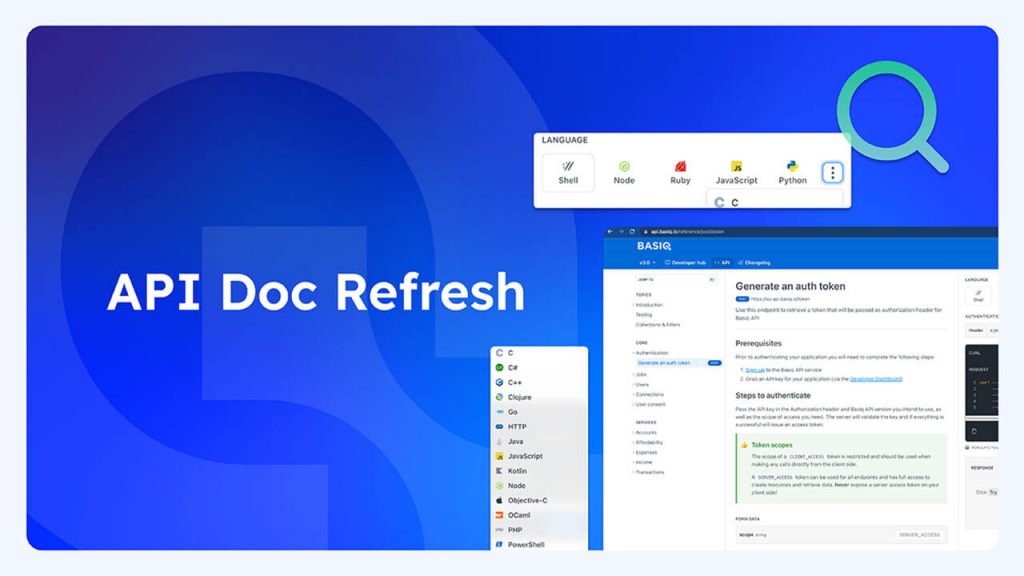

- Learn more about account verification including an example of how companies like Afterpay use the Basiq platform for account verification.

- Accelerate time to production with the Basiq account verification starter kit – a template project that you can use to generate your own project to get to market faster. All you need is your API key to spin up a fully functional account verification app.

- Discover how to instantly verify accounts via the Basiq platform using Connect – a secure, reliable and unbeatable account verification method. If you want to know more about Connect, contact our team.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.