How Zepto is Using Basiq

We’re working with Zepto Payments to enable merchants to avoid dishonour fees and deliver a frictionless experience to customers. Zepto is using the Basiq Open Banking Platform to enable customers to choose to securely connect their bank accounts to simplify bank transfers and create a seamless payment experience.

According to the Reserve Bank of Australia, Direct entry (direct debit and direct credit) transactions grew by 8.6% in volume in 2016 to 3.5 billion transactions. Direct debit payments make up approximately 1.08 billion transactions per year with up to 20% failing for reasons such as insufficient funds or incorrect account details. This means that Australian merchants waste approximately $432 million in dishonour fees a year. That doesn’t even account for administration costs in dealing with failed payments and involuntary churn due to dishonours.

Why Basiq?

With Basiq, it’s possible to ensure that customers have enough money in their account and verify that the account information is correct before the transaction is made, enabling Zepto to have 99.8% confidence that all direct debits will be successful. Plus, the merchant can preemptively communicate with the customer before a payment fails if they don’t have sufficient funds. This is a revolutionary way to solve a problem which has been ‘plague’ to the payment industry from the beginning.

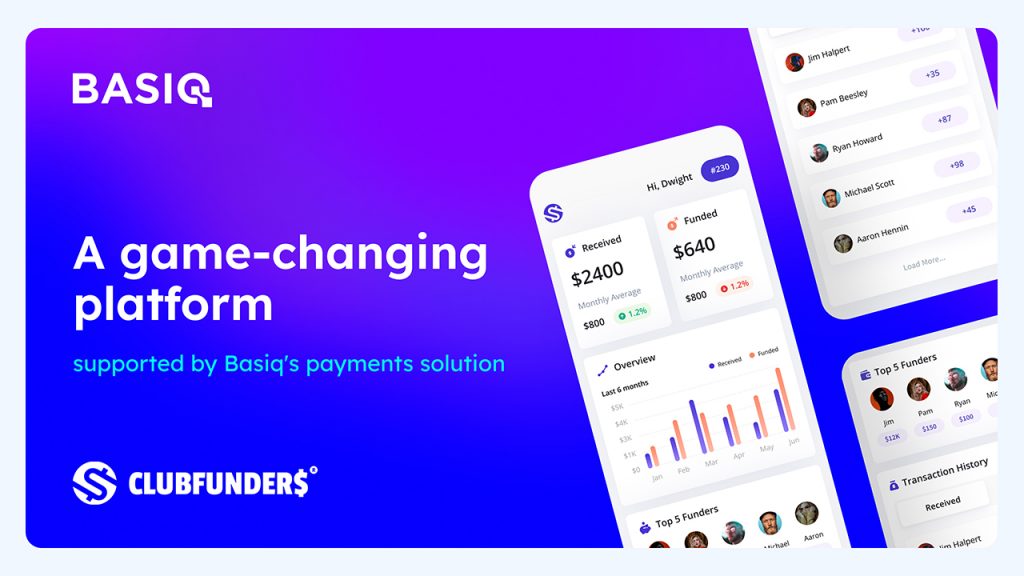

About Basiq…. We’re a CDR-accredited Open Banking platform providing the building blocks of financial services. Our APIs enable secure access to customer financial data and tools to uncover valuable insights. Backed by AP Ventures, Salesforce Ventures, Reinventure, NAB Ventures and Plaid, over 200 fintechs and banks rely on our platform to deliver innovative financial solutions across lending, payments, wealth, digital banking and more.

About Zepto… Zepto is a payment fintech that simplifies bank transfers. The Zepto payment platform allows merchants to create a seamless, customer-centric payment experience for their customers. Zepto’s API connects to a merchant’s existing accounting and POS system to enable them to automatically collect payments from their customers.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.