With rising inflation and the growing cost of living, more and more Aussies are finding themselves in debt. In fact, Australians have one of the highest percentages of net household debt, with the average household debt increasing by 7.3% from 2021 to 2022.

But Pokitpal is on a mission to change this narrative. Having originally launched a B2C round-up product to help Aussies save money and pay down debts, PokitPal has evolved into a B2B white-labelled solution helping organisations build and launch their own cashback and round-up platforms.

Earlier this year, Sipora was acquired by Pokitpal, allowing the team to expand their impact and help organisations from charities to superannuation funds and even investing platforms tap into the full potential of round-ups.

We sat down with Sipora’s co-founder, now Head of Partnerships at PokitPal, Samuel Torpey to learn more about the story behind the platform, their recent acquisition by Pokitpal and how Open Banking is supporting this team on their journey.

What is Sipora?

Sipora is Australia’s leading round-up platform, on a mission to help organisations and their customers find new, innovative ways to harness the power of round-ups.

You’ve probably heard of round-ups in the context of investing, with apps helping customers to round up their everyday purchases and invest the rest. But the Sipora team knew round-ups could be used for a wide range of uses, including saving and paying down debts.

As Samuel shares, “We came across a study that explains that customers are four times more likely to save $5 per day versus $150 per month… because a small amount seems easier to reach and more palatable. So we built our entire platform around that idea.”

PokitPal and Sipora: The perfect pairing

Samuel always knew that Sipora’s round-up product was better suited to a larger ecosystem of products, rather than a standalone app.

Earlier in 2023, PokitPal (a cashback shopping platform with over 1,500 retail partners all over Australia and New Zealand) acquired Sipora.

PokitPal was already servicing customers like Virgin Money, Raiz and Beem It with their white-labelled cashback and rewards product, while Sipora was also servicing organisations with their white-label round-up product. It was clear the pair would ultimately be a better fit working together under one name.

“The two products really complement each other well. We found that rather than working side by side, working under the PokitPal banner would probably be better suited for us both in the long run,” explains Samuel.

How PokitPal is helping charities harness the power of round-ups

The pandemic caused major disruptions to a range of industries, including charities and not-for-profits. Event-based donations, in particular, took a major hit and forced charities to get creative with their fundraising efforts.

Interestingly, people’s willingness to donate didn’t change during the pandemic. Instead, they needed new ways to give back to the causes and organisations they cared about. Luckily, PokitPal’s round-up product was the perfect solution.

Samuel explains, “We were able to work with a number of charities to launch their own round-up product themselves. It allows people to round-up their everyday purchase to the nearest $1, $2 or $5 and donate that to the charity.”

Individuals have total control over how much they donate through the use of spend control, while charities reap the benefits of a white-labelled solution that could be up and running in weeks – not months.

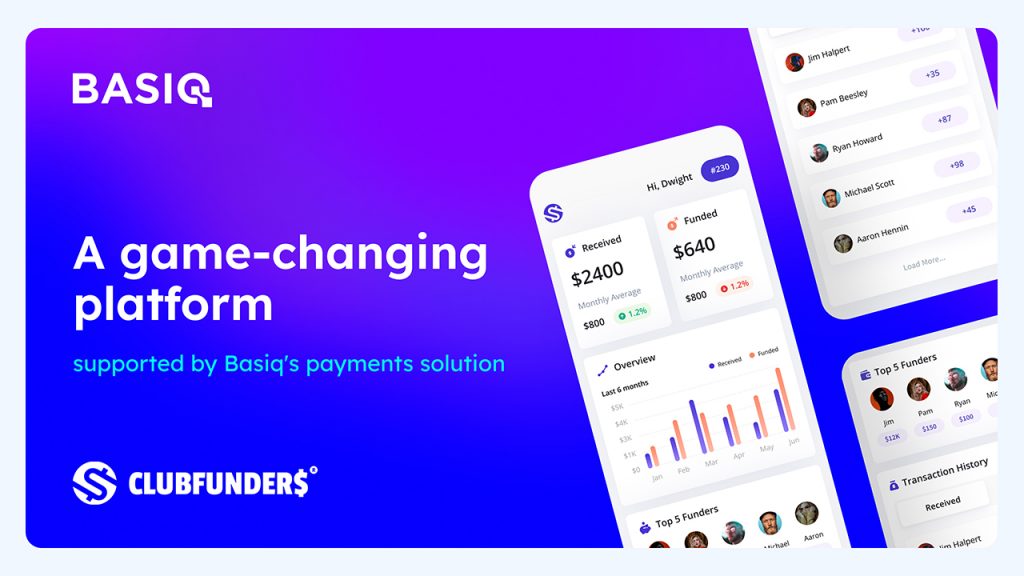

How Open Banking via Basiq fits into the equation

A big challenge for PokitPal was gaining access and connecting to their customer’s accounts. Previously, they were reliant on individuals entering their banking details which proved a major point of friction in the onboarding journey.

Many users didn’t have their banking details on hand when signing up, causing them to drop off right at the point of conversion.

But with Open Banking, powered by Basiq and Sipora’s Representative status, PokitPal streamlined and fast-tracked this process. As Samuel reveals, “I believe that Basiq is the leader in this space in Australia and New Zealand, especially when it comes to Open Banking.”

“We’ve already seen an 80% reduction in the time it takes a user to connect their account, just from changing providers to Basiq and using its Open Banking connectors. This is crucial for us when it comes to customer satisfaction and retention,”

“Transistioning has opened up a large cohort of new customers banking with institutions that only allow connectors via Open Banking – like Up Bank that is servicing hundreds of thousands of young Australians that fit within our target demographic,” explains Samuel.

Security is also a big focus for Samuel and his team. Choosing an Open Banking provider that is heavily invested in building and maintaining a secure platform (like Basiq) gave him and his customers valuable peace of mind.

What’s next for PokitPal?

Samuel explains the major focus for Pokitpal is connecting with as many organisations as possible that want to deliver cashback rewards and round-up products to their customers. Their immediate focus is to expand their white-labeled partners across both Australia and New Zealand.

As Samuel says, “We’re looking for new partners, people that have scoped out trying to build a cashback or round-up product and how can we help them. And we’re really excited to be able to go out and share the news of the acquisition and really focus on delivering more products to a larger number of organisations.”

Find out more about PokitPal and how they’re helping organisations tap into the power of round-ups, rewards and cashback initiatives.

PokitPal is accessing Open Banking via the Basiq platform and supported by Basiq’s Connect and Enrich solutions. Interested in learning more? Get in touch with our team.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.