As I reflect on 2024, I can’t say I’m brimming with excitement. It’s not that I’m in a gloomy mood; it’s just that I see the year as a time for laying the groundwork, in preparation for a long and rewarding journey.

Let’s take a step back for a moment.

Did you know it took nearly nine years to build the Sydney Harbour Bridge? In the early years, progress was slow and hardly noticeable. Yet, this bridge was instrumental in shaping Sydney into the vibrant city it is today, opening up new areas for development and becoming a key part of the city’s infrastructure. This year and in 2024, in the financial sector, we’re doing something similar – we’re in the midst of building not just one, but multiple bridges that will eventually lead to a transformative shift in the way we engage and consume financial services.

Here are the ‘bridges’ we are continuing to build in 2024:

Consumer Data Right (CDR)

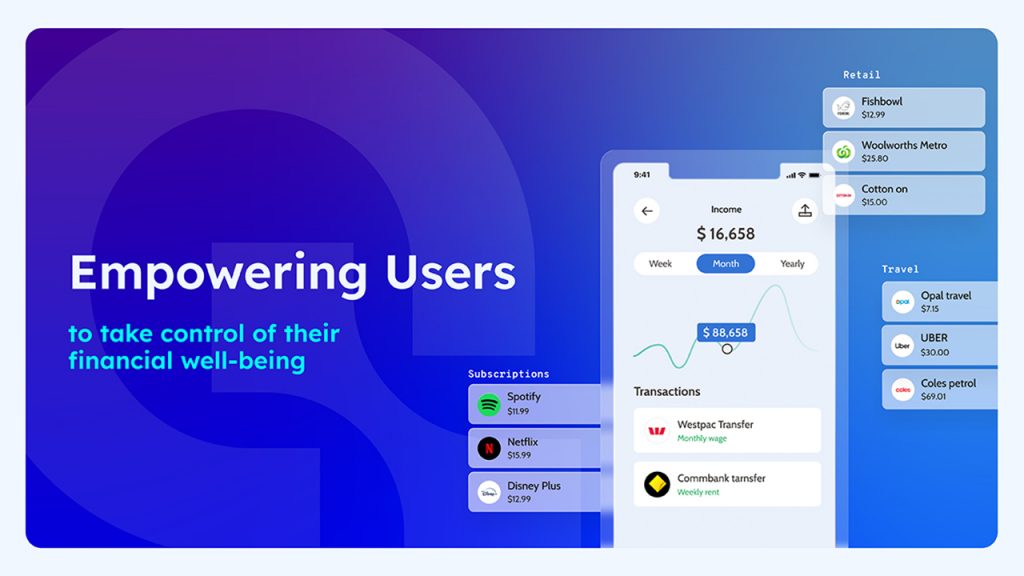

The Consumer Data Right has been implemented in the banking and energy sectors and is soon to be extended to non-bank lenders. Although the initial volume of usage has been moderate, adoption is steadily increasing. Over 200 businesses have been assisted in integrating CDR this year alone. The CDR is evolving as a primary method for data access, particularly as an alternative to traditional data scraping methods. Learn more about the CDR here

New Payments Platform (NPP)

The New Payments Platform represents a significant shift from traditional batch-based payment systems. It includes features like Pay ID and the emerging PayTo system, which enables real-time transactions. Adoption of PayTo is gradually increasing among banks, and it is anticipated that the majority of banks will fully support this system by 2024. This evolution marks a move towards more efficient and instantaneous payment processes. Learn more about the NPP here

Trusted Digital Identity Framework (TDIF)

The Australian Government has initiated the Trusted Digital Identity Framework to accredit identity providers. This framework sets stringent standards for usability, privacy, security, risk management, and fraud control. Its implementation is expected to streamline identity verification processes across various sectors, reducing reliance on government-only identity systems and fostering a diverse range of industry-provided identity services. Learn more about TDIP here

Artificial Intelligence (AI)

In the financial services sector, the adoption of AI is progressing, albeit cautiously due to the highly regulated nature of the industry. While significant impacts of AI in this sector may not be immediate, the technology is continuously evolving. This evolution suggests a broader range of applications and solutions emerging by 2025, extending beyond current AI capabilities. Learn more about Open AI here

Hardware Developments

Concurrent with software advancements, there have been notable developments in hardware technology. Noteworthy examples include Nvidia’s HGX H200, a top-tier AI-focused chip, and new wearable technologies such as the Humane AI Pin and virtual reality hardware set to be released in 2024. These hardware advancements are expected to significantly alter the interaction with software and will eventually change the way consumer interact with their finances.

So you can see why I’m not jumping up and down about 2024. It won’t be about instant gratification or headline-grabbing breakthroughs – we’re in the middle of a marathon, not a sprint. We’re doing the hard yards now, laying down the foundation for something truly groundbreaking. It’s about patience and persistence.

Looking ahead to 2025 fills me with immense excitement. As we step into the year, we’ll be greeted by a robust real-time payments infrastructure, a well-developed data sharing ecosystem, and significantly advanced AI technologies. Each of these elements, potent on their own, will be capable of transforming their individual domains. However, it’s their synergy, amplified through a variety of cutting-edge hardware devices, that will revolutionise how we interact with financial services. This convergence of innovations promises to reshape our financial landscape in ways we’re just beginning to imagine.

Here is to the hard work and challenges waiting for us in 2024 🍻