Buy Now Pay Later

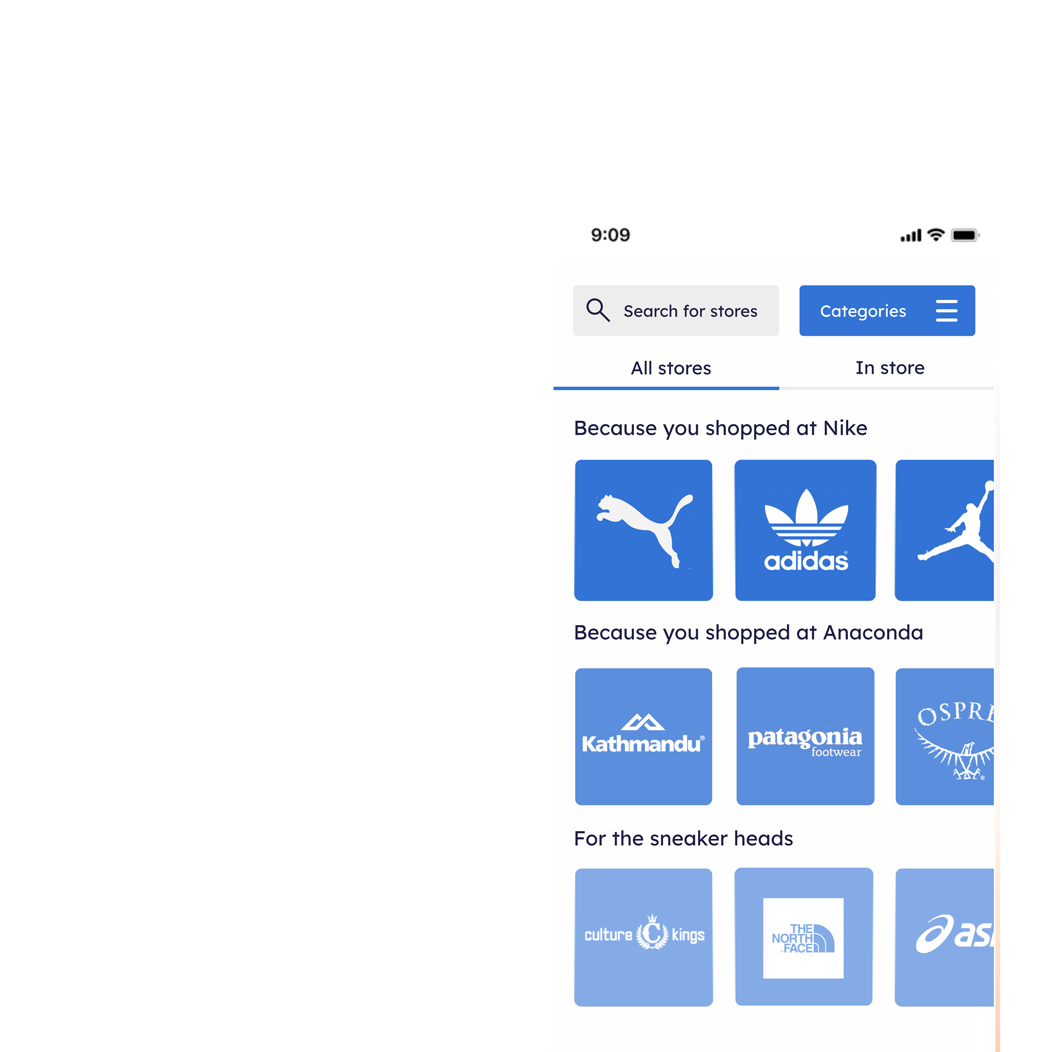

Drive growth in BNPL

The use of financial data and insights enables a number of growth opportunities for BNPL providers. Instantly know more about customers to personalise offers and gain more insights about merchants your customers are shopping at.