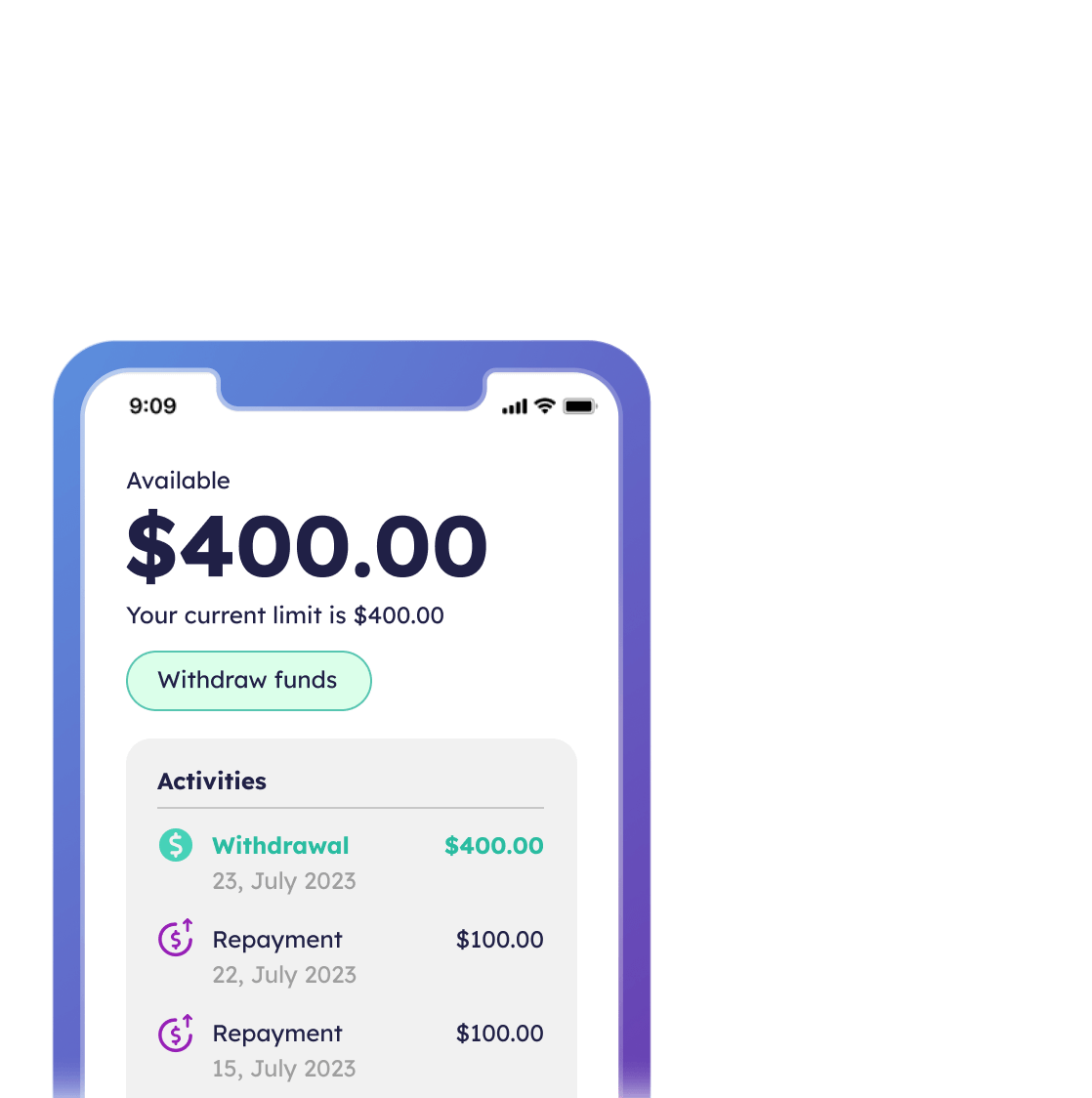

Salary Advance

Drive growth in Salary Advance services

Use financial data and insights to quickly onboard your customers and provide a frictionless customer experience. Undertake serviceability assessments, ensure successful deposit of funds, and easily set up repayments.