Write access and the future of third party payment initiation

With consumers having the ability to share data via CDR Open Banking, what are some possible use cases?

‘Open Finance’ is a term used to describe the accessibility of core financial services made available through APIs. This allows for the sharing of data across multiple financial institutions driven by consumer consent, as well as being able to do something with that data once shared, such as a payment.

The following white paper visualises what a truly Open Finance ecosystem looks like, with references drawn to Australia where necessary to add additional context.

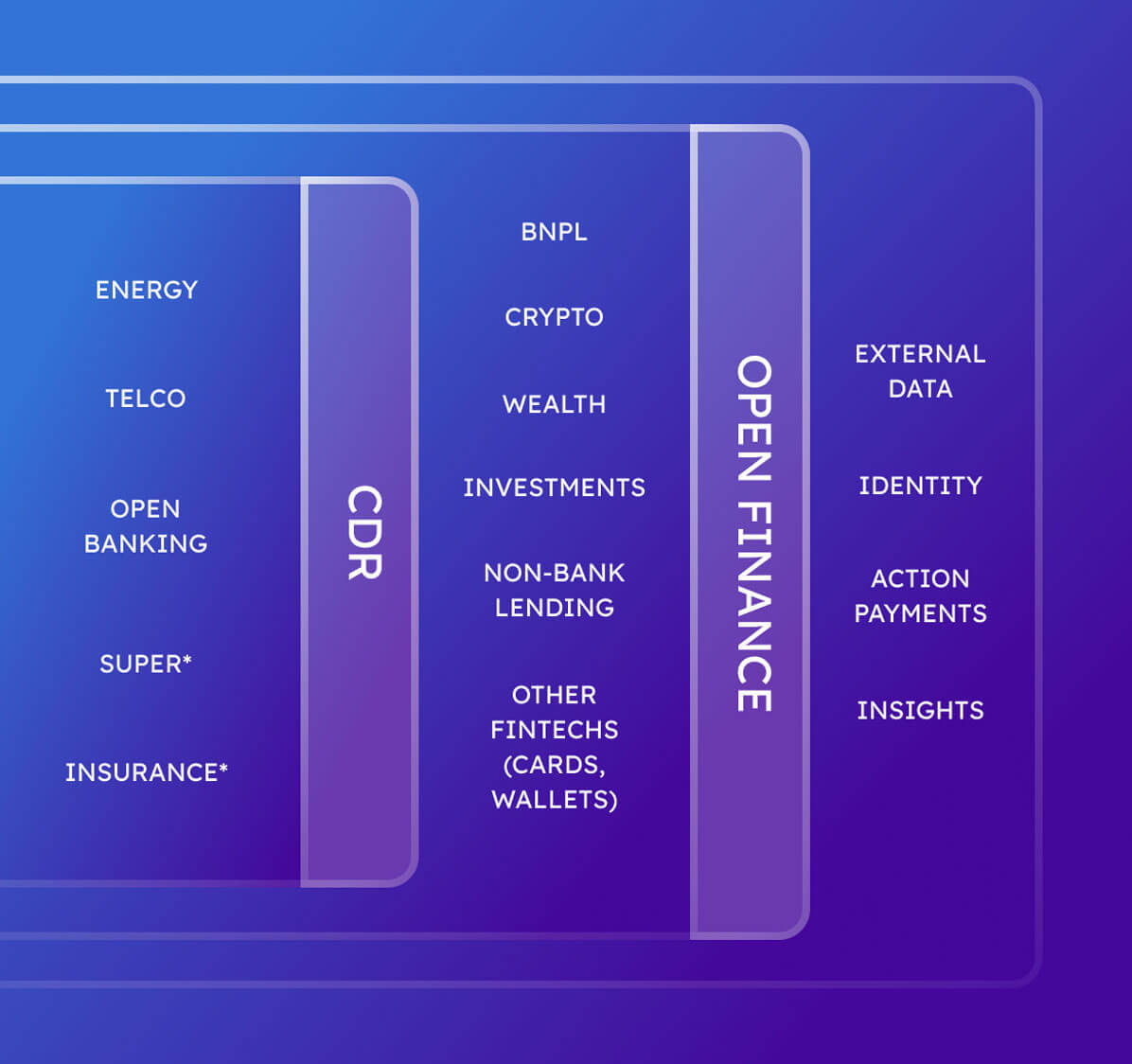

Open Finance ecosystem model

An interconnected Open Finance ecosystem requires the core layers of Data, Insights and Actions. The proposed model outlines how the core layers interact with other inputs and outputs in the broader economy.

Open Finance components

There are four critical components that are required to create and enable an Open Finance ecosystem. This includes consent, data, insights and actions.

Benefits of Open Finance

While complex, Open Finance presents benefits to consumers including increased consumer empowerment, innovation and competition, increased financial literacy and consumer choice.